The purpose of diversification is to reduce risk. The rationale behind diversification used to be that booming cycles of some asset classes offset the bust cycle of other assets.

Diversification made sense in an environment where some asset classes boomed while others got busted, but that isn’t the case anymore.

Today most asset classes ebb and flow at the same time, but at different degrees. This makes diversification less effective and possibly dangerous.

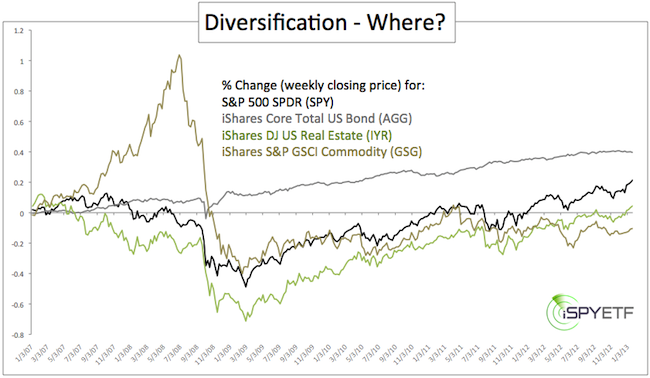

The first chart shows the percentage change of the following asset classes/ETFs since January 2007: S&P 500 SPDR (SPY), iShares Core Total US Bond ETF (AGG), iShares Dow Jones US Real Estate ETF (IYR), and iShares S&P GSCI Commodity ETF (GSG).

In early 2007 stocks and commodities cushioned the decline in real estate prices. In 2008 commodities lessened the sting of falling stock and real estate prices.

Then came quantitative easing and it’s become clear ever since that all asset classes swim in the same liquidity pool. Some swim faster, some slower, but all float with the tide.

Different Approach to Diversification

A less popular, more contrarian and quite possibly more effective approach to diversification involves simple under appreciated cash.

Based on Rydex funds flow data, investors are despising cash like never before. Low interest rates are partially to blame for the great cash exodus, but excessive enthusiasm for stocks is probably the main motivation.

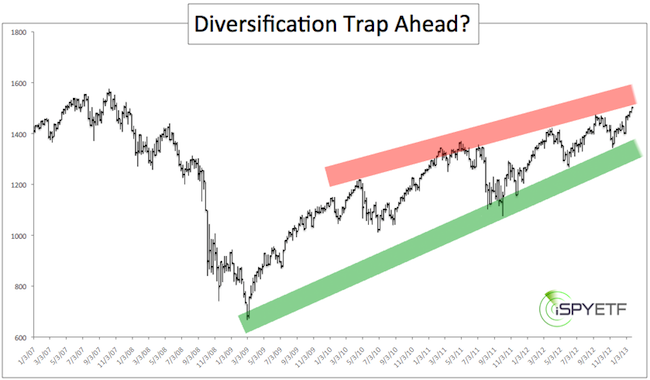

The second chart illustrates basic support (green) and resistance (red) ranges for the S&P 500. The S&P tends to get overbought in the red and oversold in the green zone.

Over the past years, investors did well to diversify out of stocks (and other assets) into cash when prices reached the red resistance range and rotate out of cash into stocks (and other assets) in the green range.

The S&P is about to reach overbought territory and risk is rising. Raising cash may offer more risk protection than diversification.

The Profit Radar Report will provide specific trigger levels indicative of a trend change from up to down.

|