Subscribers to iSPYETF’s free e-mail newsletter receive a market outlook, usually once a week. The market outlook below was sent out on January 21. If you’d like to sign up for the free e-newsletter, you may do so here (we will never share your e-mail with anyone, just as we don't accept advertising).

Here's your 'broken record' moment of the day: The tug-of-war between extreme sentiment and breadth continues as stocks grind higher (2 steps forward, 1 step back).

If you're not yet familiar with this epic, never before seen tug-of-war, it was explained here on December 1 with the following conclusion:

"Normally the combination of historic investor optimism while stocks are pressing against long-term resistance is a recipe for disaster. But, as the above studies show, strong stock market internals are likely to over-power other risk factors."

Our approach has been, and continues to be: Higher prices are likely as long as support holds.

But, extreme euphoria brings risk of a nasty pullback, so I'm also trying to discern where that risk potential might turn into reality.

The dashed trend channel center line could be a 'pressure point' for the iShares Russell 2000 ETF (IWM).

The detailed 2021 S&P 500 Forecast includes an actual S&P 500 price projection for 2021 based on the following factors:

-

Breadth & liquidity

-

Technical analysis (support/resistance & Elliott Wave Theory)

-

Investor sentiment

-

Seasonality & cycles

-

Valuations

-

Risk/Reward Heat Map

The latest gold analysis is available here.

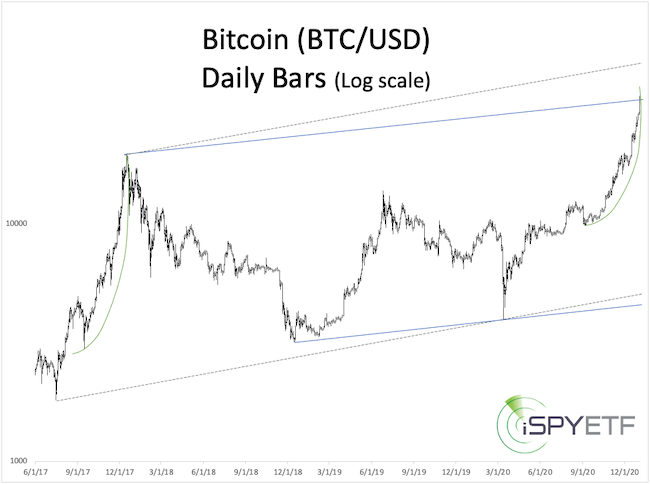

The January 6 Profit Radar Report included the Bitcoin chart below along with this warning:

"Bitcoin has gone parabolic, and Bitcoin futures jumped another 16.7% on Sunday afternoon. If Sunday’s pop holds, price will open above the blue trend channel on Monday, which will then act as support (around 33,000). The rally has taken the shape of a bowl (green line) and I don’t recall a ‘bowl-shaped’ rally that didn’t end badly. Based on Elliott Wave Theory, any upcoming pullback could be ‘only’ a wave 4 and not as strong as in 2018, but nevertheless, any remaining gains come with the risk of a quick 20-40% pullback."

Bitcoin Futures are down some 30% and price is threatening to fall below the blue channel. While there is more down side risk, there's a good chance Bitcoin will recover to new highs once this correction is over.

Continued updates and the new 2021 S&P 500 Forecast are available via the Profit Radar Report.

The Profit Radar Report comes with a 30-day money back guarantee, but fair warning: 90% of users stay on beyond 30 days.

Barron's rates iSPYETF a "trader with a good track record," and Investor's Business Daily writes "Simon says and the market is playing along."

|