Earnings season is in full swing and most financial heavy weights are due to report this week.

Yahoo!Finance writes that: “It's a make or break week for the financial sector with five of six of the nation’s largest banks (JPMorgan, Goldman Sachs, Citigroup, Bank of America, and Morgan Stanley) scheduled to report fourth-quarter earnings results” this week.

Earnings are directly related to stock market valuations, but big bank earnings releases are nothing more than a ritualistic farce. Why?

There’s no simple answer, but the next few minutes will be well worth your time. Warning! Knowledge about banks’ (corresponding ETF: SPDR S&P Bank ETF – KBE) accounting standards will result in loss of faith in the financial sector’s worth.

From Mark-to-Market to Mark-to-Make-Believe

There was a time when banks loved the Mark-to-Market accounting model, because it allowed them to showcase truly miraculous real time profits. By 2006/07 the financial sector accounted for over 40% of S&P 500 earnings.

Things changed in 2007/08. Mark-to market was unpopular with banks because it would have shown enormous real time losses. Bankers preferred to hide their balance sheets, along with the Federal Reserve and Congress too.

Bankers lobbied the Financial Accounting Standards Board (FASB) to change the fair market accounting rule – rule 157 – but the FASB resisted. Changing fair market or Mark-to-Market was a free pass that practically required no write-downs ever.

However, via the Emergency Economy Stabilization Act of 2008, Congress gave the SEC the authority to suspend Mark-to Market accounting. FASB rule 157 was suspended on April 2, 2009.

FASB 157 – What Does it Mean?

Since April 2, 2009, banks are basically free to value their toxic assets as they please. This example illustrates how the financial engineering formula works in real life.

Bank ABC holds mortgage-backed assets originally valued at $1,000. After running some proprietary and non-verifiable models the bank determines it will eventually sell the asset for $950. The loss, termed credit loss, is only $50.

However, because of MBS bad rep, the banks portfolio is currently worth only $500. The actual current value ($500) minus the credit loss ($50) is called noncredit loss ($450).

The $450 noncredit loss is recorded on the balance sheet under “comprehensive income,” but is not run through the income statement. Those losses don’t affect earnings, and are excluded from banks’ regulatory capital calculation.

Extreme Financials

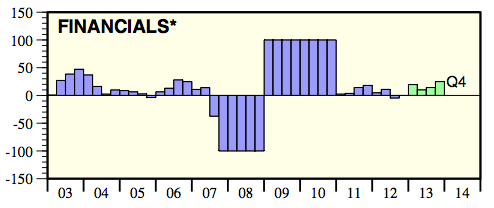

The chart below (courtesy of Yardeni Research) illustrates the effect of financials. The worst recession since the Great Depression caused five quarters of extreme earnings contraction followed by eight quarters of extreme earnings growth (yearly growth rates were capped at +100% and -100% due to extreme values).

Was the miraculous earnings recovery due to a fundamentally strengthening financial sector (corresponding ETF: Select Sector Financial SPDR – XLF) or accounting tricks?

|