The Risk/Reward Heat Map (RRHM) is essentially a sophisticated 'pros and cons' list that visually expresses whether risk or reward will dominate over a specific time frame.

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report

Process of Compiling RRHM

-

The calculation starts with identifying a unique event, such as: The S&P 500 broke to a new all-time high for the first time in 1 year (more examples of events below are listed below).

-

Once the event is identified, we look for past events (or occasions) that fit the same criteria.

-

Once past events are identified, we calculate the forward performance (for each individual event) for the next 1, 2, 3, 6, 9, 12 month.

-

Once the forward returns are calculated, we consider the result an indicator, study or signal (ISS).

-

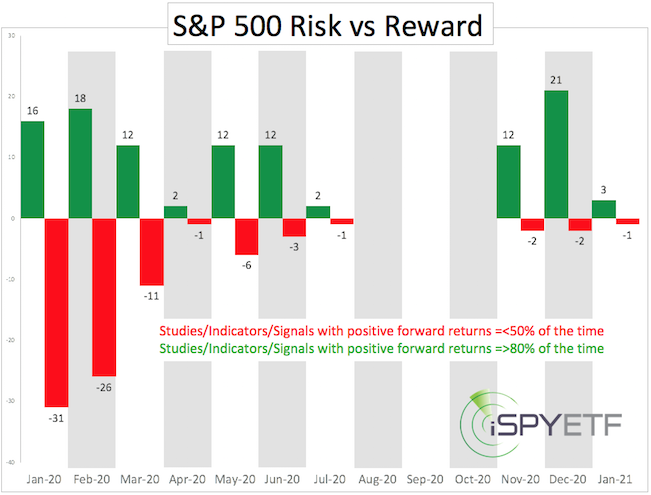

If 80% or more of a particular ISS show a positive return for a certain timeframe, it is added to the bullish column for that time period. One ISS can be bullish or bearish for multiple time frames (I.e. ISS is bearish for the next 2 and 3 month, but bullish for the next 6 and 12 month)

-

If 50% or less of a particular ISS show a negative return for a certain period of time, it is added to the bearish column for that time period.

Here is an actual example of an event and corresponding ISS published in the December 15, 2019 Profit Radar Report:

Event: For the first time since January 26, 2018 (474 days ago), the NY Composite set a new all-time high.

ISS: The NYC reached a new high for the first time in more than 400 days 8 other times since 1970.

2 weeks later, the NYC was up 4 times (50%), 1 month later up 6 times (75%), 2 month later up 7 times (88%), 3 month later up 8 times (100%), 6 month later up 7 times (88%), 1 year later up 8 times (100%).”

Below is a sampling of events that have been considered in the past. The examples are listed to show the depth and variety of events used to compile the risk/reward heat map. “X” and “[]” indicate variables.

-

[index] may refer to S&P 500, Nasdaq, Dow Jones, Russell 2000, NY Composite

-

[high or low] may refer to all-time high, 52-week high, highest or lowest level in X days/weeks/month, X above or below a moving average, bollinger band, or other indicator.

-

[indicator] may refer to RSI, MACD, CBOE put/call ratio, hedgers’ exposure, NY Composite a/d line, unemployment claims, yield curve, analyst estimates, sentiment polls, Hindenburg Omen signals, technical breakout or breakdown, period of time above/below certain threshold, or other sentiment, economic, breadth, liquidity indicator

Examples of Events

-

[Index] registered a new [high or low]

-

[Index] registered a new [high or low] for the first time in [X] days

-

[Index] registered a new [high or low] for the first time in [X] days, while [indicator] set new [high or low]

-

[Index] came within [X] percent of a new [high or low] while [indicator] stayed [X] above or below [high or low].

-

[Index] registered a new [high or low] while [x] percent of [indicator] set new [high or low]

-

[Index A] outperformed [index B] for [X]

-

[Index A] outperformed [index B] for [X] while [indicator] set new [high or low]

-

[Index] traded [X] consecutive days above [indicator]

-

[Index] traded [X] consecutive days above [indicator 1] while above [indicator 2]

-

CLICK HERE FOR A LIST OF ACTUAL STUDIES (ISSs) INCLUDED IN THE RISK/REWARD HEAT MAP

Analysis

There are 3 ways to categorize the RRHM:

-

Total signals (bullish and bearish)

-

Net signals only

-

Change (total or net) for a specific timeframe

Analysis #1 and #2 allow us to identify time periods of elevated risk or reward. Time is only one component of market forecasting, price is another - more important - one. A break below support or above resistance is usually required to start validating the message conveyed by the RRHM.

Analysis #3 allows us to identify changes. For example: The RRHM may project risk in February. If true to the projection, the S&P 500 drops X % in February, and ISSs start giving much more bullish signals, the RRHM change may indicate when a bottom is in.

The most recent RRHM will be available via the Profit Radar Report (along with a detailed interpretation and analysis of other factors), but below is a copy of the January 1 RRHM. Since January 1, an additional 56 ISS have been catolgued and included in the RRHM.

Continued updates, projections, buy/sell recommendations are available via the Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF, LLC and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's evaluation of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

|