Sunday’s (September 29) Profit Radar Report concluded that: “If 2,938 breaks, the S&P 500 may quickly drop to 2,890 and potentially 2,820.” On Tuesday the S&P closed at 2,938 and yesterday/today fell as low as 2,855.

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

This was one of the easier short-term setups, but how does this breakdown fit into the bigger picture?

Bigger Picture

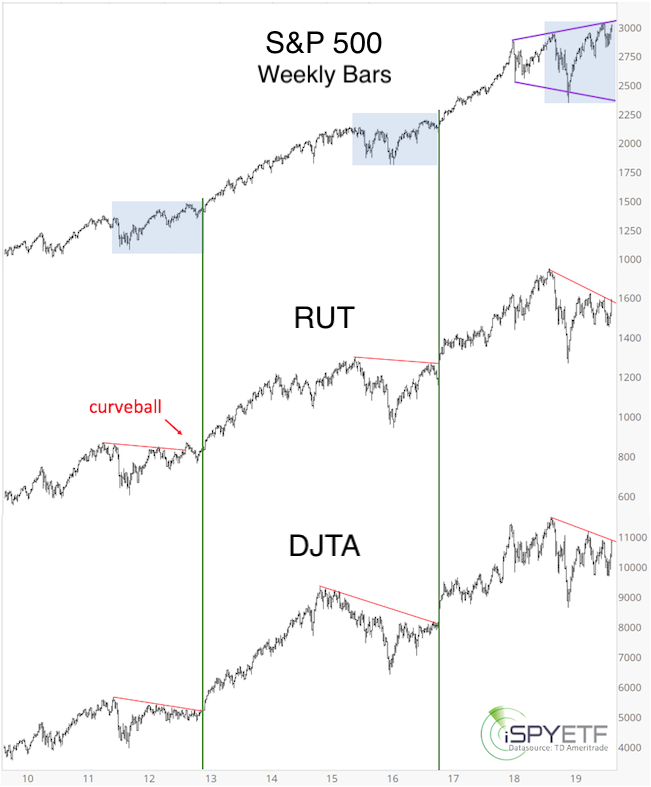

The September 15 Profit Radar Report featured the chart below, which showed that S&P 500, Russell 2000 and Dow Jones Transportation Average were at key resistance.

One major financial news website declined to publish the chart and story because “it doesn’t say much.” I politely disagreed, because the message - although not sensational - was profoundly simple and important:

Don’t buy stocks while three major indexes are below resistance and still have to prove themselves. Or, as the September 15 Profit Radar Report put it:

“While below 3,045, we allow seasonality and cycles to pull stocks back down. A move below 2,945 is needed for lower targets though.”

Down-turn Confirmed?

Does the drop below 2,945 confirm a new down-turn?

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF e-Newsletter

We are getting close, but as mentioned in yesterday's Profit Radar Report, we need another up/down sequence. How come?

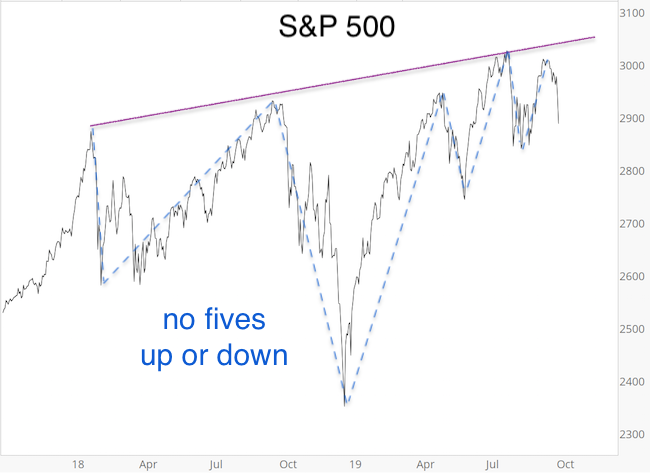

The dashed blue lines below highlight recent directional moves. None of them (rallies and declines) unfolded in a discernable 5-wave pattern. According to Elliott Wave Theory, 5 wave moves identify the prevailing trend. The lack of 5-wave moves explains why the market has been range-bound rather then trending.

On a smaller scale, the decline from the September 19 high appears like only 3 waves, thus far. Another up/down sequence (waves 4 and 5) would make for a small 5-wave decline and increase the odds of a trend reversal (a projection of the ideal next move was published in yesterday's Profit Radar Report).

Until that happens, we note that the S&P 500 is near support, getting over-sold and ready for a bounce (the up portion of the up/down sequence?).

There is another simple reason why I want to see a clear 5-wave move lower before getting more bearish: The August selloff triggered a number of sentiment extremes usually seen near a bottom, and the subsequent rally triggered a number or breadth and momentum signals usually indicative of further gains.

Continued updates, projections, buy/sell recommendations are available via the Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's evaluation of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

|