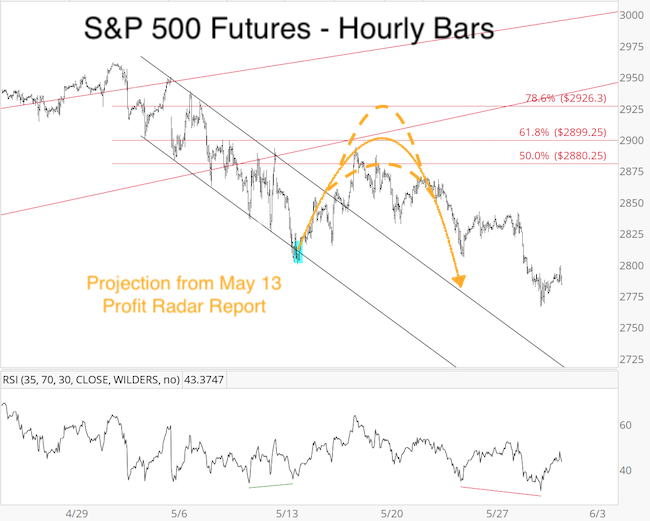

The S&P 500 has been following the yellow projection published in the May 13 Profit Radar Report. The original projection along with updated price is shown below, the original May 13 Profit Radar Report update is available here.

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

KISS

Moving forward, here is a very simple approach: Lase week, the S&P 500 broke below long-term black trend channel support. This support is now resistance (around 2,830). Additional resistance is provided by last week’s low (2,801).

While below 2,801 - 2,830 we are looking for more weakness.

A move above resistance could unlock a rally to about 2,900, which would likely be an excellent opportunity to go short.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF e-Newsletter

Longer-term Projection

The projection below was published in the April 28 Profit Radar Report. It shows two different paths:

-

Black labels: Wave B of 4 ended at May 1 high. Wave C of 4 is now underway. Ultimate Wave C target is around the December 2018 low. Once complete, wave 5 will carry the S&P to new highs.

-

Outlined in purple is an expanding triangle formation (this formation looks better in the DJIA, but is projected using the S&P 500), where the May decline is wave E. Completion of wave E will be followed by new highs. It’s important to note that wave E does not have to drop as low as illustrated.

Regardless of the final path, here are two key takeaways:

-

For now the down side risk is potentially significant

-

Price and momentum studies strongly suggest that - once this correction is over - stocks will rally to new all-time highs.

Summary

While below resistance, we are looking for new lows. Once the S&P 500 reaches our next down side target (and inflection point), we’ll gauge how big of a bounce may develop.

Down side targets, bounce potential, and any curveballs will be available via the Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's evaluation of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

|