Facebook

The following analysis was published in the October 28 Profit Radar Report:

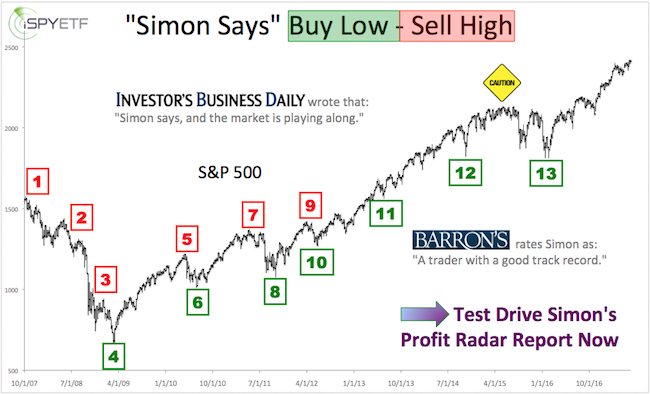

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

“Facebook has been ‘wedging’ lower. It is now at triple support, shows a tiny bullish divergence, and cycles are turning strongly bullish. Upon completion, wedges like this are often completely retraced, which means the up side target is around 188. Aggressive investors may choose to buy Facebook.”

Facebook rallied as much as 12.49% since Monday’s low. Cycles continue higher, and (FB) should rally towards and perhaps beyond 188.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

SPDR S&P 500 Homebuilders ETF (XHB)

The following analysis was published in the October 21 Profit Radar Report:

“The SPDR S&P Homebuilders ETF (XHB) is one of the most hated ETFs right now. In September XHB languished in over-sold territory for 10 consecutive days without bounce. Daily RSI-35 (not shown) is the most over-sold since August 8, 2011. Trade is currently below two (red) long-term trend lines. Trend channel support is around 33.13.There are no bullish divergences. In summary, XHB is down 28.75% since January, and is over-sold enough to spark a powerful spike at any time. However, there are no bullish divergences indicative of a lasting low. Perhaps this will change by the time XHB reaches the black trend channel.”

October 28 Profit Radar Report:

"XHB closed below the black trend channel on Friday, but with a bullish divergence. A move back inside the channel (above 32.90 on Monday) and above trend line resistance (33.25 and 33.70 on Monday) could unleash a strong bounce. Aggressive traders may buy accordingly.”

Since Monday’s low, XHB rallied as much as 7.95%. Based on sentiment and technicals, further gains are likely.

The Profit Radar Report monitors key indicators to spot low-risk or high probability opportunies. Click here to subscribe or learn about our approach.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|