From January 26 – August 15, the iShares MSCI Emerging Markets ETF (EEM) lost 20.3%. A bear market is commonly defined as a decline of 20% or more. Based on this definition, EEM entered a bear on August 15.

Will the emerging markets bear market continue, or is it a false signal?

Emerging Markets Bear Market? The 'Two Week Rule'

To assess emerging markets future prospects, we will look at other times EEM lost 20%.

As the chart below shows, since its inception in 2004, EEM fell 20% five other times. How it performed two weeks later, tended to be an indication of its longer-term prospects.

Two weeks after its initial 20% drop, EEM was higher 3 times, and lower 2 times. 4 out of 5 times, the subsequent gain or loss was significant (>7%).

The 3 times EEM was higher two weeks later, it was also higher three months later (on average 5.7%). The 2 times EEM was lower two weeks later, it was also lower three months later (average of 3%).

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

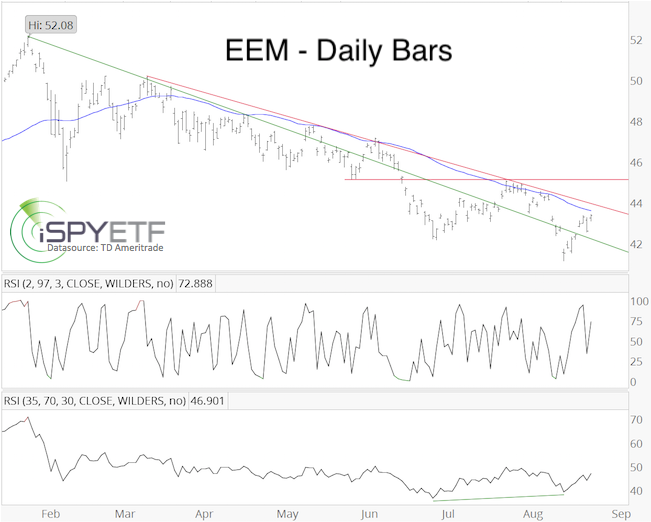

The chart below shows EEM since its January high. Since ‘entering bear market territory,’ EEM already rallied more than 5%, and it looks like it will be up two weeks after triggering a 20% decline.

Trade is just below its 50-day SMA and trend line resistance around 43.80. There was a bullish RSI divergence at the low.

It seems like EEM has a good shot at moving higher, but a move above 43.80 is needed to start confirming a perhaps more lasting bounce.

Other popular emerging markets ETFs include:

-

Vanguard FTSE Emerging Markets ETF (VWO)

-

iShares Core MSCI Emerging Markets ETF (IEMG)

-

Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE)

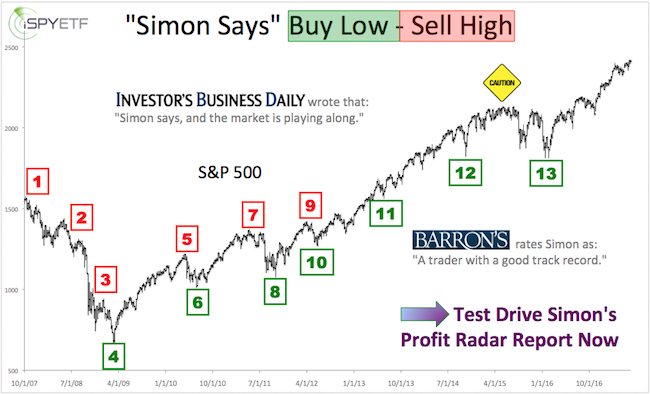

Above analysis was initially published in the August 26 Profit Radar Report. Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|