The June 6 bigger picture S&P 500 update showed 3 projections, all of them were bullish.

2 month later, the S&P 500 filled the open chart gap at 2,851.48 (chart gaps act like price magnets) and is within spitting distance of a new all-time high.

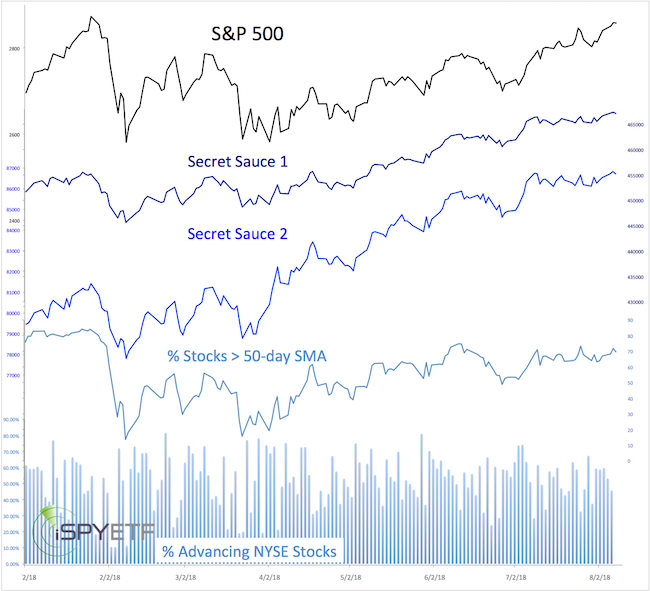

As the chart below shows, the S&P 500 is also near a pretty significant resistance cluster.

The confluence of trend channels and the January all-time high almost make it seem like it’s ‘now or never’ for bears, but is it?

Now or Never?

The July 25 S&P 500 update discussed the tug of war between a massively bullish pattern and bearish divergences. Despite the bearish divergences, the update concluded that: “Further gains are possible while above 2,830 and 2,800, but bearish divergences (while they exist) suggest the risk is elevated.”

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Thereafter the S&P fell 50 points, but support at 2,800 held.

The rally from the August 2 low has now erased many of the bearish divergences existent in late July (see chart below).

Resistance vs liquidity

The tug of war is now resistance (around 2,870) vs positive liquidity. How so?

Resistance may (and should) cause a pullback, but the new all-time highs of my favorite liquidity indicators (shown as secret sauce #1 and 2) suggest any pullback will be temporary.

Therefore it’s not ‘now or never’ for bears to step up, but they do have a window of opportunity.

The plan of action remains the same it's been for years. Buy the dips.

Continued updates are available via the Profit Radar Report.

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|