2017 was one of the most unique years ever, not just for the stock market, also in terms of world events and natural catastrophes.

An almost unprecedented phenomenon was that of strong stock market momentum.

The November 19, 2017 Profit Radar Report pointed out that:

“The S&P 500 was higher 8 of the first 9 months of 2017. This has only happened 8 other times (1936, 1950, 1954, 1958, 1964, 1995, 1996, 2006). 2, 3, 6, and 12 month later the S&P was higher every time but one (0.7% loss 2 month later in 1964). Such strong momentum readings (and they are seen across all time frames) are extremely rare. As mentioned back in December 2016 and March 2017, stocks rarely ever top at peek momentum. We have to go back to 1995/96 to find similarly strong and persistent up side momentum.”

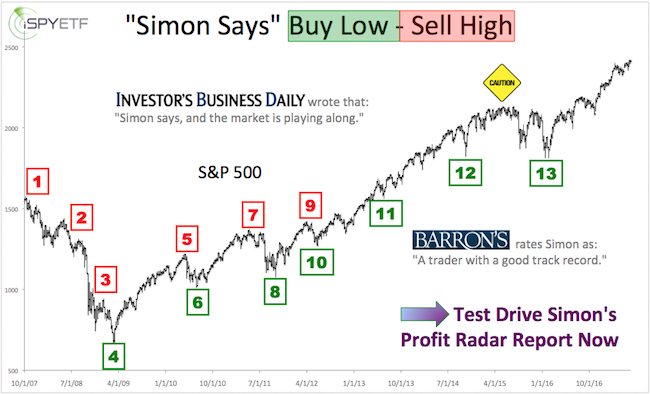

Barron's rates iSPYETF as "trader with a good track record" and Investor's Bussines Daily says "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

Diametrically Opposed

Strong momentum was in direct contrast to some of the oddest breadth readings ever, also mentioned by the November 19, 2017 PRR:

“Despite stocks hovering near all-time highs, there have almost been as many stocks with bearish extremes (new 52-week lows or oversold RSI) as bullish extremes (52-week highs or overbought RSI). This happened on multiple days. For example:

Last week more than 8% of stocks had a RSI reading above 70 (overbought). At the same time more than 8% of stocks had a RSI reading below 30 (oversold).

The week before last week saw a lot of buying and selling climaxes at the same time.

At some point last week, 4% of stocks registered new 52-week lows while 30% of S&P 500 stocks fell below their 200-day SMA. That's dispite stocks being near their all-time high.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

This kind of split market is rare (when it occurs near all-time highs) and historically unhealthy (it triggered a cluster of Hindenburg signals). Similar (bad) breadth readings existed 11 other times since 1998. 1, 2 and 3 month later the S&P 500 was down 76% of the time.”

Reconciling Conflicting Indicators

There was no easy way to reconcile the conflict among indicators, but the November 19 PRR concluded that: “Therefore it seems more likely that momentum (supported by seasonality) will trump breadth and push prices higher in coming weeks.”

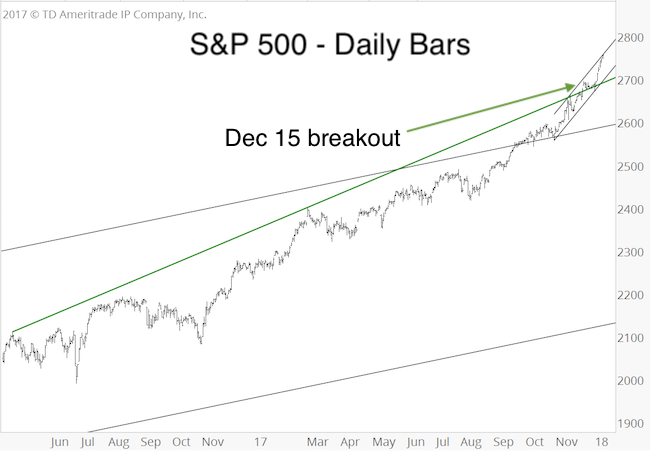

At times like these, it’s often best to use simple trend lines as arbitrator. The November 28, 2017 Profit Radar Report pointed out a Dow Jones Industrial Average (DJIA) breakout (see chart) and stated:

“The DJIA closed for the first time above the (now) green trend line going back to April 2016 (blue circle). As long as trade remains above the trend line, we’ll allow for further gains.”

On December 15, the S&P 500 closed above its respective trend line, and the Profit Radar Report stated: “The S&P 500 closed above the red trend line for the first time (similar to the DJIA on November 28). While above this trend line, gains may continue (even accelerate).”

An up side target in the low to mid 2,700s was given (and already exceeded).

Outlook

Stocks are now at a position similar to December 13, 2016, and March 2017, when the PRR pointed out that: “Stocks rarely ever top at peak momentum.”

Of course, stocks are now also overbought and have become over-loved. This means there is a fair amount of short-term risk. However, it will take some down side ‘escape velocity’ to break the up side momentum and spook investors (the next resistance level to watch is around 2,830).

If and once this happens, we anticipate a 5-10% pullback.

Continuous updates are available via the Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|