|

|

| How Much is the Dow Worth in Real Currency |

| By, Simon Maierhofer

|

| Wednesday January 02, 2013 |

|

|

|

|

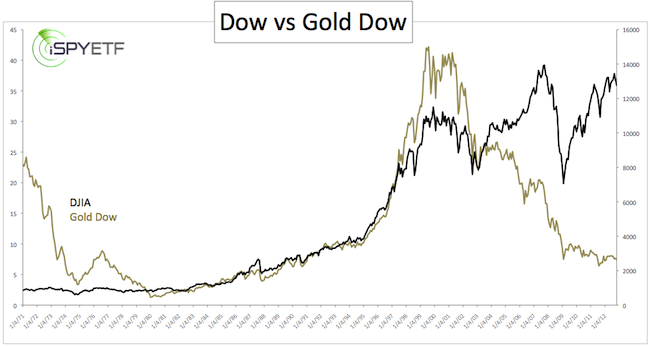

| The Federal Reserve is devaluing the U.S. dollar. Contrary to popular belief that hasn't resulted in outright or obvious inflation, but as the Gold Dow shows, it is eating away at the Dow's value. |

|

How do you define value and is value important today or is value just relative?

After all, as long as you buy low and sell high, the value of the underlying stock, index or ETF doesn’t matter, or does it?

If you buy the Dow (or Dow Diamonds – DIA) at 13,000 and sell at 14,000 you pocket a nice profit, but was it a good value buy?

Obviously profits are always right, but value often determines profits. At least that used to be the case before the Fed’s flooded the market with liquidity.

Old souls that remember the name Charles Dow and his saying “to know values is to know the market” may find the chart below of interest.

It measures the Dow in the only real currency – gold – that’s why I call it the Gold Dow.

The Dow in U.S. dollars is shown in black, the Gold Dow is shown in gold. At the 1999 Gold Dow peak, the Dow Jones was worth 42 ounces of gold. Today it’s barely worth 8 ounces.

The 81% drop in the Gold Dow is largely due to gold prices, which soared from 260 in 1999 to 1,600 and above.

Thus far the Dollar Dow has been able to resist the path of the Gold Dow. In fact, there's been a divergence for most of the past decade, so this is not a short-term timing tool. Nevertheless, other valuation indicators suggest that the Dollar Dow will eventually follow the footsteps of its golden cousin.

|

|

|

|

|

|

|

|

|

|

|

|

|

|