Crude oil dropped more than 10% since mid-April. Does this alter our 2017 oil forecast?

As mentioned in our 2017 oil forecast (published February 8 here), investor sentiment and seasonality did not line up for a sustainable move (in either direction). We therefore expected a relative trading range.

Ideally this trading range would conclude with a push to about 60.

However, the April 9 Profit Radar Report stated that: “Trade is nearing overbought, and the resistance cluster at 52-55 is up next. Within the bullish stretch of seasonality, there is a short-term cyclical high next week. Smart money hedgers have significantly reduced their short positions. In summary, oil may show some weakness in the coming week(s).”

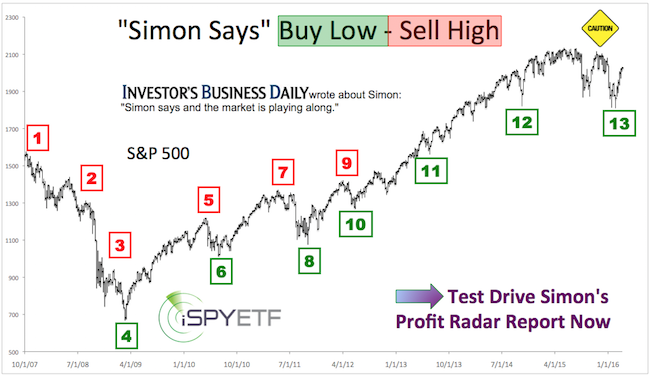

Barron's rates iSPYETF as "trader with a good track record" and Investor's Bussines Daily says "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

The entire rally since the February 2016 still appears to be a complex wave 4 correction. Wave 4 corrections are notorious for prolonged, unpredictable trading ranges (with an up side bias).

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

One of the unique features of waves 4 is that the rally can conclude without a new price extreme (the April high did not eclipse the prior January/February high). It is therefore possible that oil is already on its way to new lows.

Seasonality allows for more weakness in coming weeks, but remains strong until September. Short-term, trade is nearing the ascending green support trendline as oil is getting oversold. There should be a bounce.

The Profit Radar Report continuously monitors a wide selection of indicators to identify low-risk and high probability setups.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|