The full year S&P 500 forecast is my biggest project of the year, and quite frankly it’s kind of a thankless job. Why? It gives every critic a documented, black and white foundation for criticism.

It is impossible to predict a full year of stock market future, that's why market forecasts are loaded with ‘ifs,’ “buts,’ and other ambiguities. Anyone attempting to predict the unpredictable is doomed to miss the mark.

That would explain why no other newsletter (at least not that I’m aware of) publishes an actual full year S&P 500 chart projection (2016 projection shown below). Accountability is an underrated (if not entirely ignored) concept on Wall Street. But what’s the purpose of following many time-tested indicators if we don’t put them to work?

Subscribers to the Profit Radar Report deserve a straight-forward forecast. My goal is to provide a rough roadmap for the year ahead, based on what indicators are telling us right now.

Barron's rates iSPYETF as "trader with a good track record" and Investor's Bussines Daily says "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

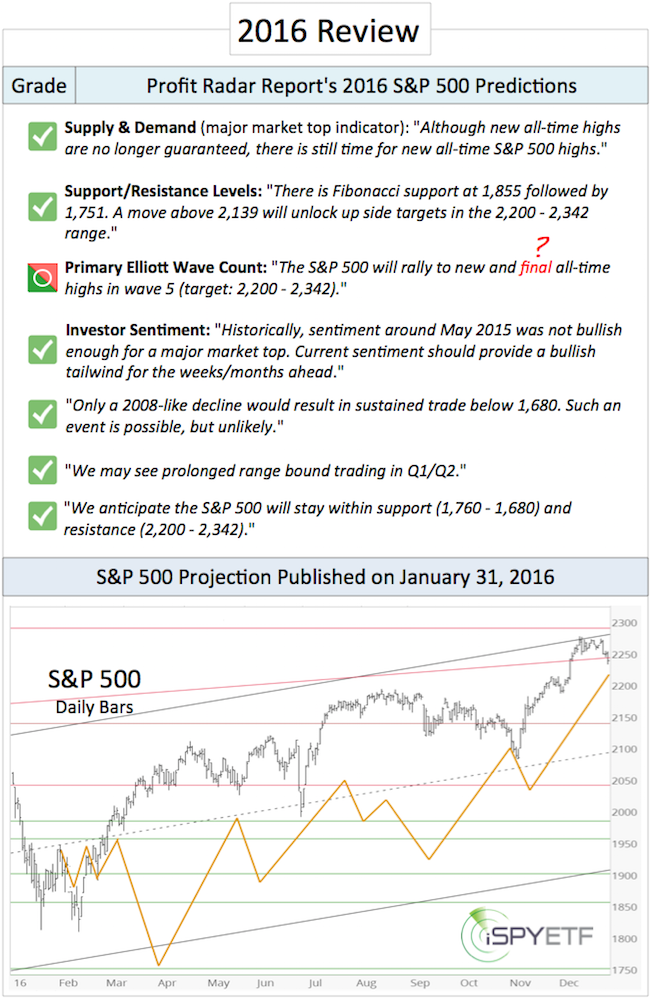

Before we get to the 2017 S&P 500 Forecast, here is a review of the 2016 S&P 500 Forecast, published on January 31, 2016.

2016 S&P 500 Forecast Review

Below is a review (and small excerpt) of our 2016 S&P 500 Forecast, based on four key indicators (supply & demand, technical analysis, investor sentiment, seasonality and cycles). Each indicator/forecast is graded with a green pass, red fail or red/green draw symbol.

At the time of publishing (January 31, 2016), our bullish 2016 outlook was truly contrarian.

A more detailed version of the 2016 S&P 500 Forecast was published here.

2017 S&P 500 Forecast

It wouldn’t be fair to re-publish analysis paid for by subscribers here for free, but I feel comfortable sharing a few key points.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

The 2016 S&P 500 Forecast featured this Elliott Wave Theory based forecast, which pointed to new all-time highs with a target around 2,290.

Our major market top indicator (click here for more details) confirmed the most recent S&P 500 highs. This means a major market top is, at minimum, months away.

The up side target has been adjusted accordingly. In fact, the 2017 S&P 500 Forecast expounds on a more bullish Elliott Wave interpretation (which was first discussed in the August 28 Profit Radar Report).

We will crosscheck the S&P 500 future S&P 500 pattern against our major market top indicators and investor sentiment (the 2017 S&P 500 Forecast includes a sentiment comparison between 2007 and 2017) to determine whether upcoming all-time highs will be a major top or not.

Beware of 15% Correction!

Despite the bullish potential, and even if this bull market has (much) further to go, the S&P 500 is likely to suffer a 15% correction in 2017.

Why and when, and much more detail, is revealed in the Profit Radar Report's 2017 S&P 500 Forecast

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|