The S&P 500 is trading at the same level where it was on July 8. Such a 15-week chop zone is pretty boring, but it doesn’t stop there. The S&P hasn’t made any net progress since May 2015.

When the broad market is stale, it makes sense to look at other opportunities.

The Profit Radar Report always scans various markets and sectors for sentiment extremes or seasonal trades with the potential to provide returns independent of the broad market.

Thus far this year, we’ve found such returns in gold, silver, natural gas, small caps, VIX and the utility sector.

Utilities ETF

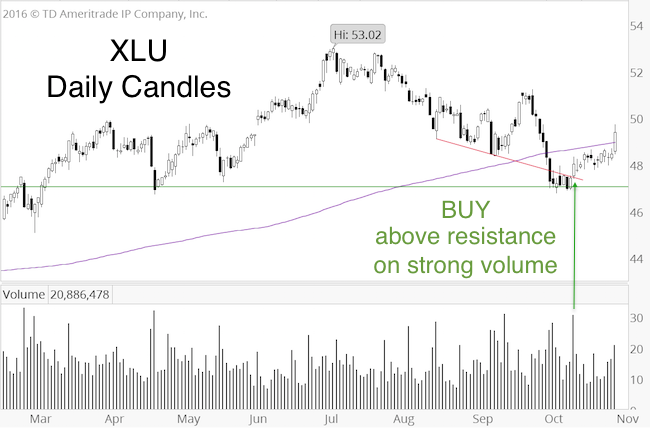

The October 12 Profit Radar Report pointed out that every single utility sector stock has been below its 50-day SMA for more than five days. An extremely rare oversold condition.

The October 13 Profit Radar Report observed that: “XLU (Utilities Select Sector SPDR ETF) jumped above trend line resistance on strong volume. This increases the odds that some sort of a low is in place. We are buying XLU at 47.80."

Barron's rates iSPYETF as "trader with a good track record" and Investor's Bussines Daily says "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

We didn’t want to chase the S&P 500 when it bounced from its 2,120 support level on October 13, but wanted some low-risk exposure to equities.

Being oversold and overhated, XLU fit the bill.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Sometimes there is no particular up side target (as is the case with XLU), but identifying low-risk buying opportunities allows investors to either grab quick gains or hold on and ‘play with house money.’

Bank ETF

The banking sector is approaching a very strong resistance cluster.

The chart of the SPDR S&P Bank ETF (KBE) shows price near trend line resistance, 78.6% Fibonacci retracement, and where wave A equals wave C.

Additionally, there was a bearish RSI divergence at the October 27 high.

Seasonality is bearish for the first three weeks of November.

This doesn’t mean that bank stocks will crash, but it certainly indicates that buying KBE right around 35 is a risky idea.

There is no short bank ETF, but traders may consider shorting KBE or buying inverse ETFs like SEF or SKF. This setup may only lead to a short-term correction.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|