The full year S&P 500 forecast is my biggest project of the year, and quite frankly it’s kind of a thankless job. Why? It gives every critic a documented, black and white foundation for criticism.

It is impossible to predict a full year of stock market future, that's why market forecasts are loaded with ‘ifs,’ “buts,’ and other ambiguities. Anyone attempting to predict the unpredictable is doomed to miss the mark.

That’s why no other newsletter (at least not that I’m aware of) publishes an actual full year S&P 500 chart projection. Accountability is an underrated (if not entirely ignored) concept on Wall Street. But, what’s the purpose of following many time-tested indicators if we don’t put them to work?

The 2016 S&P 500 Forecast was published on January 31, 2016 and is available to subscribers of the Profit Radar Report. Below is an excerpt of the 2016 S&P 500 Forecast (with some minor edits in consideration of paying subscribers).

Barron's rates the iSPYETF as a "trader with a good track record." Click here for Barron's assessment of the Profit Radar Report.

At the time of publication, the S&P 500 traded in the mid 1,800s. One of the key questions addressed by the forecast was whether the May 2015 all-time high at S&P 2,134 marked the end of the bull market.

The S&P 500 Forecast is based on the four most powerful market-moving forces:

-

Supply & Demand

-

Technical Analysis

-

Investor Sentiment

-

Seasonality & Cycles

Supply & Demand

A detailed explanation of our 'secret sauce' major market top indicator is available here.

Technical Analysis - Support/Resistance Levels

There is Fibonacci support at 1,855 (Fibonacci projection level going back to 2002).

There is an open chart gap at 2,043.62 (just above Fibonacci resistance at 2,041). This is the bare minimum target for a Q1/Q2 rally.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

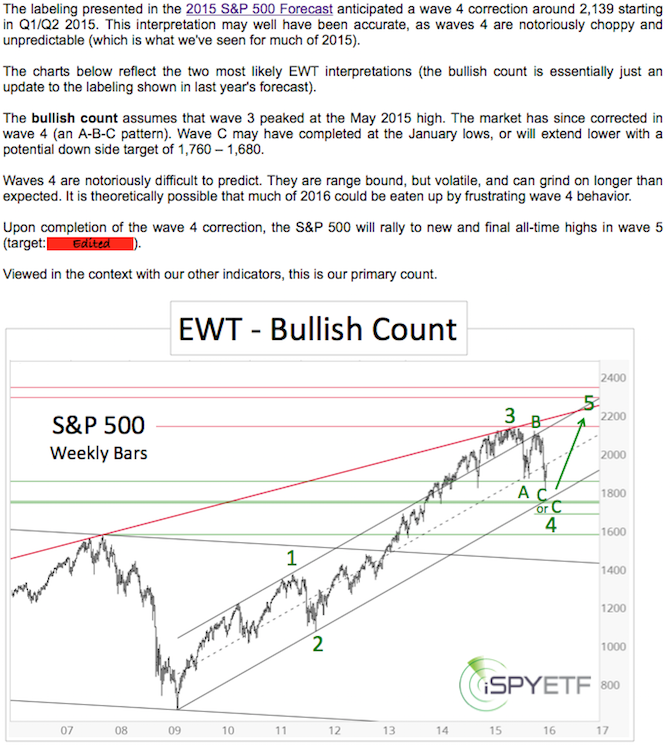

Technical Analysis - Elliott Wave Theory

Investor Sentiment

Bull markets die of starvation. Just as a fire needs wood to burn, the stock market needs fresh buyers to move higher. Fully invested investors can only do one of two things: hold or sell. Neither action buoys price any higher.

Excessive optimism is an indication that buyers have become rare (because everyone who wants to buy has already bought). That's why excessive optimism usually precedes a new bear market or sizeable correction. However, investor sentiment near the May 2015 all-time highs was not as euphoric as at prior tops.

Historically, sentiment around May 2015 was not bullish enough for a major market top.

What about current sentiment? Sentiment dropped towards extreme pessimism in January (some indicators triggered panic readings), which should provide a bullish tailwind for the weeks/months ahead.

Summary

The 2016 S&P 500 Forecast did not expect much down side following the January meltdown, but anticipated a market comeback with a ‘bare minimum up side target of 2,043.’ The projected 2016 year-end target is around 2,220.

The bare minimum target was already captured. What’s next? An updated short-term outlook is available here and here.

Continued updates are available via the Profit Radar Report. Barron's graded iSPYETF (and the Profit Radar Report) a "trader with a good track record."

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|