Sometimes, investing can be so simple … if we don’t complicate things.

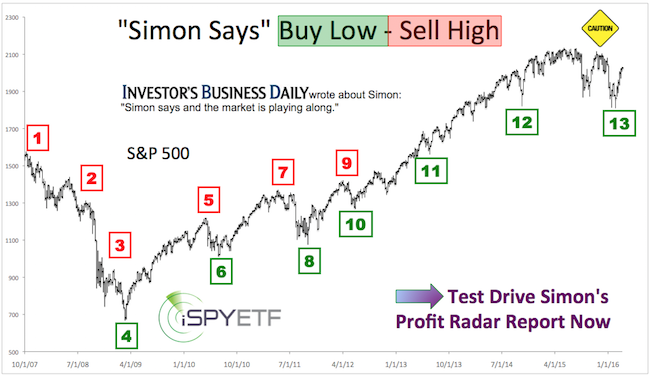

Here is the most basic of ‘indicators’. It has a 100% accuracy rate since the start of the 2009 bull market. In fact, it’s so basic, calling it an indicator is probably overkill.

Open chart gaps. The gaps we’re talking about are price gaps caused by overnight losses.

Our March 7, 2013 article “QQQ – Open Chart Gap Magnets” noted that: “Open chart gaps have acted as a magnet for the S&P 500 and Nasdaq, 100% of the time since 2010. The 2010, 2011, and 2012 declines all left open chart gaps … and all of them got filled.“

Over three years later, the accuracy rate is still 100%.

Various market indexes - including the S&P 500, Nasdaq-100 and Nasdaq Composite – left a massive open chart gap on January 4, the first trading day of the year (see chart).

This open chart gap (at S&P 2,043.62) was one of six reasons why the Profit Radar Report issued a buy signal on February 11 at S&P 1,828. This chart gap also served as our up side target.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

The S&P closed the open chart gap on March 17.

The Cohort Went Short

According to an April 5 Bloomberg article, investors were short $1 trillion worth of stocks (the highest short interest since 2008).

Looks like bears got trapped again. One reason the Profit Radar Report didn’t recommend shorting stocks is the open PowerShares QQQ ETF (Nasdaq: QQQ) chart gap; in fact, there are two chart gaps.

One at 111.84, another at 113.25. The gap at 111.84 is massive. History has taught us that shorting against chart gaps tends to be a losing proposition.

QQQ has now come within striking distance of the lower gap. There are some bearish breadth divergences already, but once the gaps are closed, the magnetic force pulling stocks higher diminishes, and the odds for a pullback increase.

A temporary pullback after (even before) closing the first gap followed by another bull leg to close the second gap is possible.

Continuous S&P 500 analysis/forecasts are available via the Profit Radar Report, which was just profiled by Barron’s.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|