Gold is the best performing asset of 2016, up 15% since December 3, 2015.

For many this must come as surprise, at least that’s what we can surmise based on various sentiment gauges and headlines at the December low. Here are a few:

-

Bloomberg: “Hedge funds boost bearish gold bets to record as rate rise nears” – Dec 1, 2015

-

Kitco: “No reason to hold gold in 2016” – Dec 3, 2015

-

CNBC: “It’s going to get much worse for gold: Technician” – Dec 4, 2015

This wasn’t the first time the financial media (or hedge funds) got it wrong. The chart below captures CNBC’s top 3 most ‘brilliant’ gold calls.

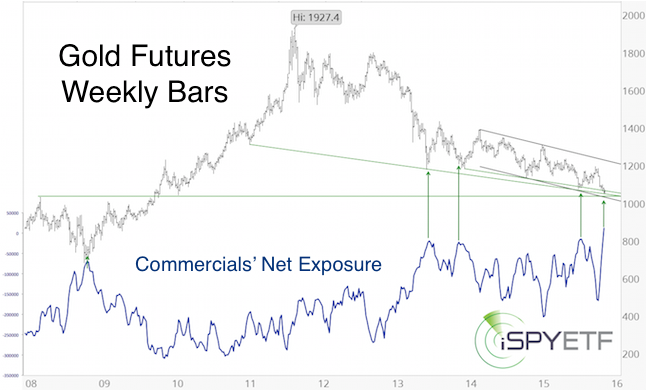

Leading up to the December low, the Profit Radar Report had been carefully watching investor sentiment developments and published the chart below in the November 30, 2015 update.

Commercial hedgers’ net short exposure dropped to the lowest level in over a decade (since hedgers are by nature net short, it looks like a ‘high’ on the chart).

Unlike the media and hedge funds, commercial hedgers are the ‘smart money.’ It rarely pays to bet against the smart money, and the smart money was looking for higher gold prices a couple months ago.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

That’s why the December 2, Profit Radar Report stated that: “There are three different bullish RSI divergences. The odds of a bounce increase with every tic lower. Hedgers decreased their short exposure further, which should bode well for prices.”

Despite being overbought, gold busted already through two resistance levels. This is long-term bullish.

Short-term, gold is near the next resistance level and is trying to take a stand against a pocket of bearish seasonality.

This gold rally has much more up side potential than the prior ones (which failed after 10 – 15% gains), but buying the dips appears more promising than chasing trade right now. Continuous gold analysis is available via the Profit Radar Report.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|