In the land of the blind, the one-eyed man is king.

In the land of low interest rates (ZIRP), high yield junk bonds are king. Never mind the additional risk. At least that’s how it used to be.

But reality has a tendency to make unexpected appearances, and it certainly made its presence known to yield hungry and risk ignorant junk bond investors.

Starting in June 2014, junk bonds turned sour.

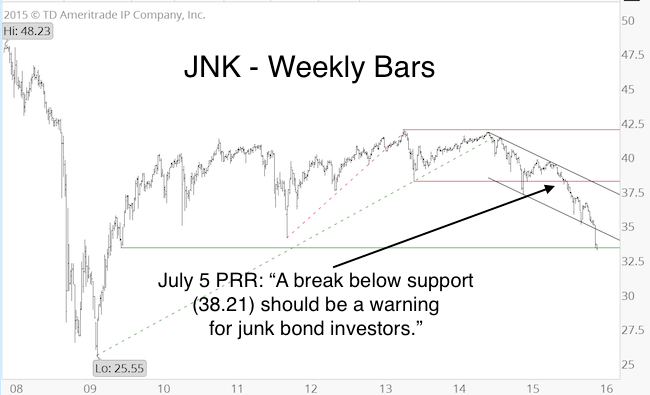

The Profit Radar Report doesn’t often touch on junk bonds, but the July 5, 2015 Profit Radar Report mentioned junk bonds’ role in a developing bear market:

“The Greek drama is fueling a fair amount of crisis talk. We anticipate an equity correction soon and a full-blown bear market eventually (2016?), but that doesn’t mean other asset classes can’t turn down sooner.

Economic recessions are a diffuse process, not a sudden all-encompassing event. Investors with money in high yield funds should watch support levels and exercise appropriate risk management.

The SPDR Barclays High Yield (Junk) Bond ETF (JNK) is trading near support at 38.21. A break below support should be a warning for junk bond investors."

JNK lost 20% since June 2014, and 13% since violating support at 38.21.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

It looks like junk bonds have entered a bear market already.

JNK may catch a bid around support at 33.30, but there are no bullish divergences. A move above the lower trend channel line is the minimum requirement to pause the selling for more than a week or two.

The junk bond decline has robbed investors (particularly retirees) of yet another income source.

Yes, economic recessions are a diffuse process, and junk bonds may be one of the first asset classes to drift into a new bear market.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|