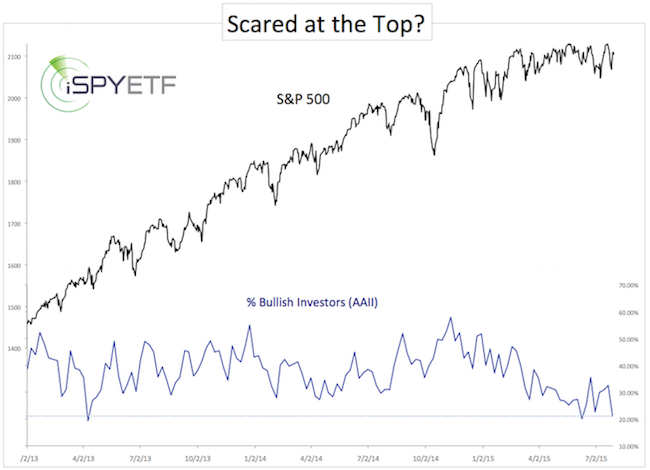

Retail investors do not like stocks right now. Only 21.11% of retail investors are bullish (based on the latest survey by the American Association for Individual Investors – AAII.

I’m not a big fan of the AAII poll (the results are rather temperamental), but the poll has persistently shown an unusually large measure of pessimism for months.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Retail investor sentiment started to sour in late 2014, even though the S&P 500 eked out a few more all-time highs in 2015.

The S&P is still within a few percent of its all-time highs, but AAII sentiment is at panic levels.

Broad excessive bearish tends to limit down side risk and increase the odds of further up side.

I wouldn’t recommend trading based on the results of this temperamental sentiment gauge, but I will carefully monitor other sentiment indicators to discern if pessimism is engrained deep enough to move stocks higher.

The Profit Radar Report consistently monitors dozens of sentiment indicators, one of them is shown here.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|