|

|

| Post June Triple Witching Generally a Weak Week |

| By, Simon Maierhofer

|

| Monday June 22, 2015 |

|

|

|

|

| Investors are always looking for an edge. Here is one seasonal and statistical edge that’s worked 13 out of the last 16 years. An 81.25% edge is about as good as it gets, but it may be even better after Monday’s pop. |

|

If you are looking for a statistical edge, here is one:

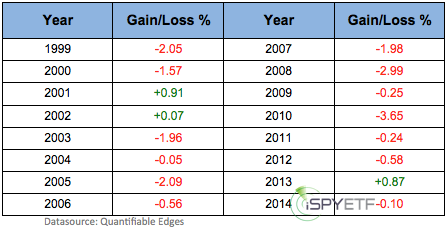

The week after June triple witching (June 19) is quite weak. How weak?

The S&P 500 (NYSEArca: SPY) has been down 13 out of the last 16 years (81.25%). Investing rarely offers such strong statistical edges.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

This morning’s 20-point jump and open gap at 2,000 likely increases this statistical seasonal edge.

Of course, any edge always needs to be viewed in context of the bigger picture.

Here is one way a weak week may fit into the bigger picture: 2015 is Shaping up to Look a lot Like 2011

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|

|

|

|

|

|

|

|

|

|

|

|

|

|