There was a minor bond scare as prices tumbled and yields soared.

The drop in bond prices makes bonds more attractive relative to stocks, at least that’s what the SPY:TLT ratio says.

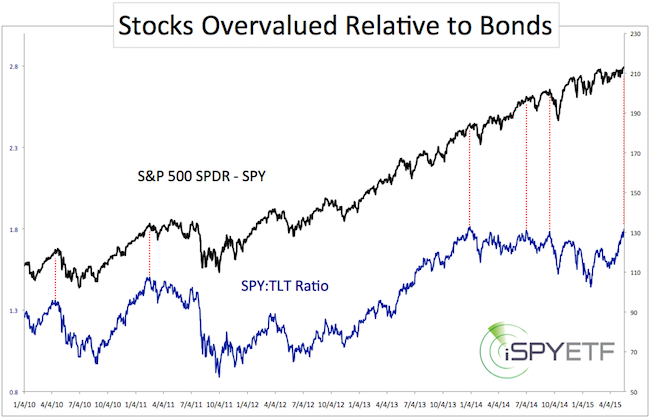

SPY represents S&P 500, and TLT the iShares 20+ Treasury ETF (NYSEArc: TLT).

The chart below, first published in the May 20 Profit Radar Report, plots the SPDR S&P 500 ETF (NYSEArca: SPY) against the SPY:TLT ratio.

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

The SPY:TLT ratio soared to a new all-time high last wee, facilitated by a strong SPY and weak TLT.

The red lines show that SPY:TLT extremes tend to have a wet blanked effect on the S&P 500, although it doesn't necessarily translate into a buy signal for bonds.

There is strong technical support for 30-year Treasury futures around 152. This should pause the decline and quite possibly spark a (sizeable?) bounce.

As far as the S&P 500 goes, the SPY:TLT wet blanked effect might be enhanced by the biggest ‘window of opportunity’ for stock market bears to take charge.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

|