The latest American Association for Individual Investors (AAII) poll showed that 49.79% of investors are neither bullish nor bearish.

This is the highest neutral reading since June 2003.

Considering that the S&P 500 (NYSEArca: SPY) is trading at all-time highs, that’s quite remarkable. Is this bullish or bearish?

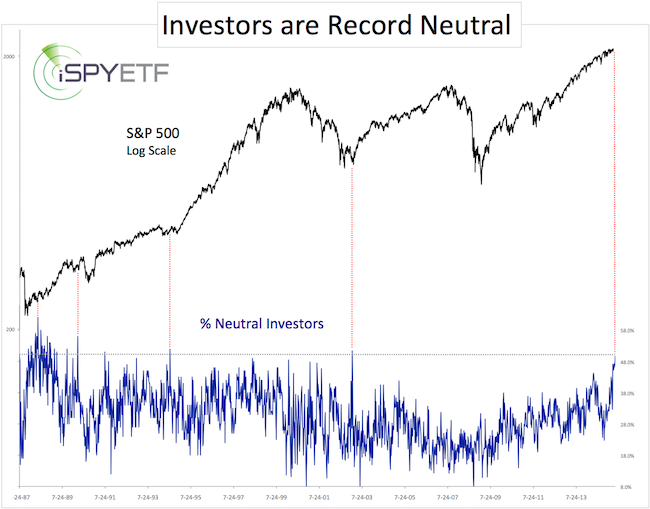

The chart below plots the S&P 500 against the percentage of neutral AAII investors, and marks similar prior readings.

It’s always tough to stuff a few decades of history into one chart, but extreme levels of apathy are usually shown after some sort of correction.

The AAII poll is one of the more noisy sentiment indicators, and I never put too much weight on it.

Get Hand-Crafted Research Delivered to your Inbox >> Sign Up for the FREE iSPYETF Newsletter

When viewed in isolation, and considering that the percentage of bullish investors is also at a 2-year low, the AAII poll results are more bullish than bearish.

Three similarly unusual sentiment readings in early May prompted the May 10 Profit Radar Report to make this comment: “The above-mentioned sentiment readings are contrary to seasonality and breadth. Nevertheless, they increase the odds of a breakout to new highs.”

The S&P 500 attained three consecutive all-time (intraday) highs since. New highs appear to have been needed to flush out premature bears (again).

Although there may be more ‘flushing’ to do, other indicators suggest risk is rising.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|