|

|

| Surprising Bearish Sentiment Extremes are Popping Up |

| By, Simon Maierhofer

|

| Wednesday May 13, 2015 |

|

|

|

|

| This is somewhat surprising. Although stocks are trading in a tight range within striking distance of their all-time highs, some bearish (bullish for stocks) sentiment readings are popping up. |

|

Stocks have been trading in a tight range near all-time highs, but an increasing number of investors wouldn’t want to touch stocks even with a ten-foot pole.

This is somewhat unusual, but is it bullish for stocks?

Here are three sentiment gauges worth noting, and how to make sense of them:

-

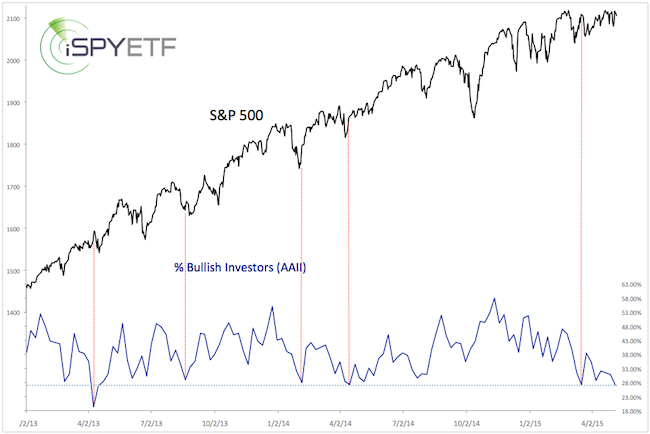

The percentage of retail investors polled by the American Association for Individual Investors (AAII) has shriveled to the lowest reading since April 2013.

The chart below plots the S&P 500 (NYSEArca: SPY) against the % of bullish investors. The red lines mark similar levels, and how such readings affected the S&P 500.

-

The four biggest index ETFs – S&P 500 (NYSEArca: SPY), Nasdaq QQQ (Nasdaq: QQQ), iShares Russell 2000 (NYSEArca: IWM), Dow Jones Diamonds (NYSEArca: DIA) - suffered $16 billion worth of withdrawals in April, one of the worst months (for index providers) on record.

-

According to the Commodity Futures Trading Commission’s (CFTC) commitment of traders (COT) report, the ‘smart money’ has reduced short equity exposure while ‘dumb money’ is selling stocks.

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

When viewed in isolation, the above-mentioned sentiment developments are bullish for stocks. However, they are contradicting the bearish message conveyed by seasonality and market breadth.

For now, we probably shouldn’t blow such bearish sentiment messages out of proportion. Stocks are still stuck in a range, and the contradiction between indicators may just perpetuate the range, or stretch it.

I would watch S&P 2,118 as line in the sand. A break above 2,118 would likely reel in buyers. Although it may not be long before ‘buyers remorse’ sets in again.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

|

|

|

|

|

|

|

|

|

|

|

|

|

|