What started out as the Exchange Traded Fund (ETF) solar system has expanded to the Exchange Traded Product (ETP) universe.

The ETP universe now consists of over 1,650 Exchange Trade Products with over $2 trillion in assets.

Various ETPs provide exposure to the following asset classes:

-

Equities

-

Fixed Income

-

Commodities

-

Currencies

-

Other (asset blends, special strategies, non-traditional assets, etc.)

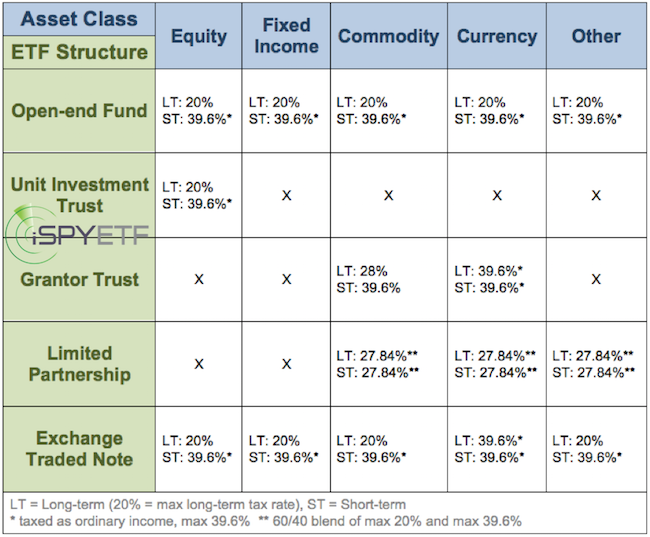

For tax purposes, Exchange Traded Products are categorized as follows:

-

Open-end Funds

-

Unit Investment Trusts (UIT)

-

Grantor Trusts

-

Limited Partnerships (LP)

-

Exchange Traded Notes (ETN)

This variety of ETPs (five-by-five matrix) creates an abundance of tax treatments.

Stay in the loop, sign up for the FREE iSPYETF Newsletter

Obviously I’m no tax advisor, and this is not intended to be tax advice in any shape or form, but to simplify the ETP taxation maze, I’ve put together an easy to read taxation cheat sheet.

LT stands for long-term capital gains, ST stands for short-term capital gains. The rates shown are based on maximum income tax rates and may be lower depending on your personal tax bracket.

Please note that Limited Partnerships (MLP) pass on partnership gains or losses to the investor. These gains/losses are unrelated to the gain/loss of the trade. I.e., USO could be bought at 10 and sold at 8. However, the MLP (which issues a K-1 form) may still report a taxable partnership gain.

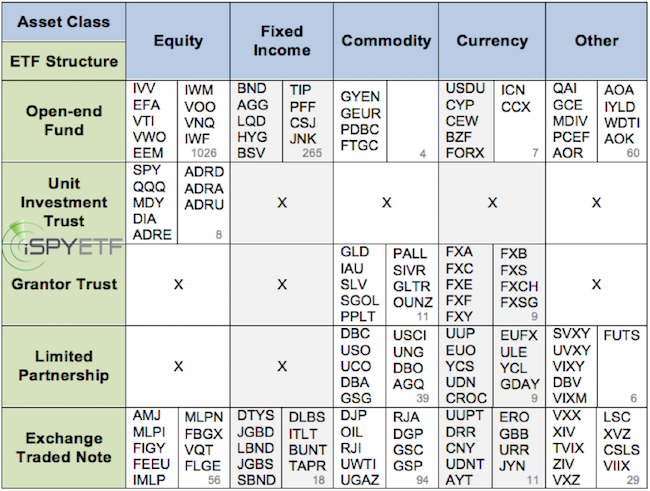

How do you know if the ETP in your portfolio is an Open-end Fund, UIT, Grantor Trust, LP or ETN? Most ETPs (1,291) are either equity or fixed income Open-end Funds.

The chart below lists the tickers of the biggest ETPs (by assets) of each category. The small gray number reflects the total amount of ETPs in any particular category.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|