Quietly, and in the shadow of it’s more popular and range bound S&P 500 cousin, the SPDR S&P MidCap 400 ETF (NYSEArca: MDY) just soared to new all time highs.

Most market technicians would grade this performance as bullish, and it may well turn out to be bullish.

However, I can’t help but be suspicious. Here’s why:

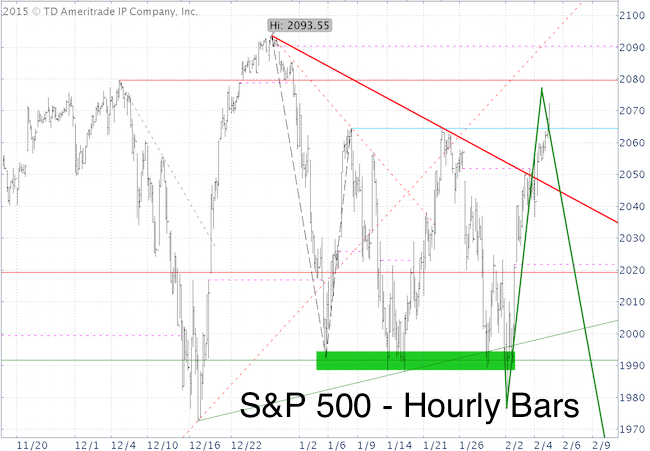

On February 1, I published the green S&P 500 (NYSEArca: SPY) chart projection for Profit Radar Report subscribers and stated:

“A drop below widely watched support around 1,990 followed by a reversal and rally towards 2,080” is very likely. The red projection would only come into play if trade stayed below 1,990.

Here is an updated look at the green projection. This projection has played out perfectly thus far, and there’s no concrete reason to abandon it.

However, there’s no room for tunnel vision either. Dale Carnegie beautifully illustrated the cost of tunnel vision:

“Here lies the body of William J., who died maintaining his right away. He was right, dead right as he sped along, but he's just as dead as if he were wrong.”

Nobody wants to be William J.

The SPDR MicCap ETF breakout, when viewed in isolation is bullish.

Even the S&P 500 broke above bold red trend line resistance, which is also bullish.

Internal market breadth has been solid, which would also allow for further strength.

However, from a psychological perspective, a reversal after the S&P 500 breaks out of its recent trading range (blue line), would trip up a great number of investors, which is what Mr. Market likes to do (it did so at the January 22 high, with a 'gnarly' MACD signal).

I stated via the February 2 Profit Radar Report that: “Swing traders may be able to scalp a percent or two (or more with leveraged ETFs) by playing this bounce, but I believe the next best opportunity will be to the down side.”

For now I’ll stick with my green projection. The market will probably tell me within the next few days if I’m wrong.

Continuous updates are available for the Profit Radar Report.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|