As MVP of the commodity sector, oil is usually in the spotlight (especially after a dizzying 60% drop) while most of the other commodities operate in the shadow.

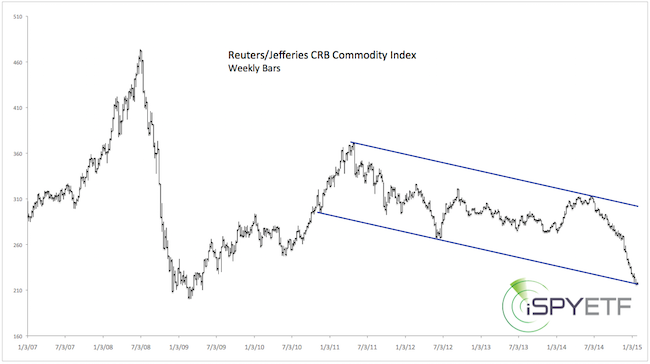

The Reuters/Jefferies CRB Commodity Index, the Granddaddy of broad commodity indexes, sports an interesting chart right now.

The index has reached the lower end of a trend channel that’s defined a multi-year down trend.

Is that a buying opportunity? Is oil near a low?

First we should look at the composition of the Reuters/Jefferies CRB Commodity Index.

In 2005, the index was revised from an equal weighted to a 4-tiered grouping system, designed to reflect the significance of each commodity. Here is the group weighting:

-

Agriculture: 41%

-

Energy: 39%

-

Base/Industrial metals: 13%

-

Precious metals: 7%

Crude oil makes up 23%. The next biggest components are gold, natural gas, corn, soybeans, aluminum, copper and live cattle with 6% each. Silver accounts for only 1%.

Since oil is the heavy weight of the Reuters/Jefferies CRB Commodity Index, trend channel support should be watched carefully for anyone fishing for an oil bottom.

Under normal circumstances this would be a low-risk opportunity to buy the Reuters/Jefferies CRB Commodity Index (trend channel could be used to manage risk).

However, there is no Reuters/Jefferies CRB Commodity ETF.

Broad based commodity ETFs include the PowerShares DB Commodity Tracking ETF (NYSEArca: DBC) and iShares GSCI Commodity ETN (NYSEArca: GSG).

DBC has a strong correlation to the Reuters/Jefferies CRB Commodity Index, but the actual chart paints a different story.

DBC already dropped below trend channel support and is near its all-time low. Aside from a Fibonacci projection level at 14.13, there is no technical chart support.

This makes it hard to manage risk effectively. Traders looking to bottom pick should probably use the Reuters/Jefferies CRB Commodity Index trend channel as stop-loss for any long positions. Oil ETFs include the United States Oil ETF (NYSEArca: USO) and iPath Oil ETN (NYSEArca: OIL).

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|