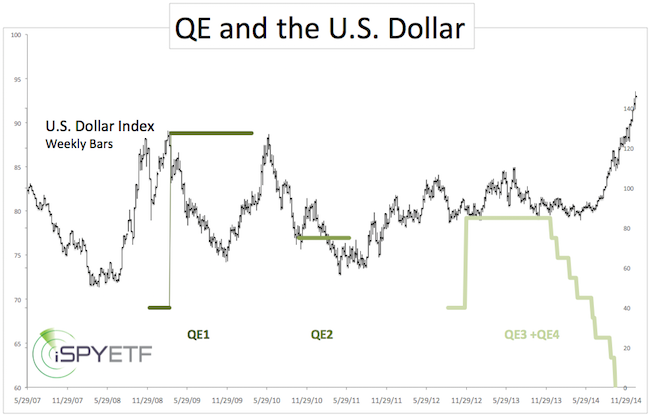

It’s not that we need a chart to show that QE pumps up Wall Street, but here is one anyway.

The obvious question is whether Europeans QE will do the same for European stocks as U.S. QE did for U.S. stocks.

Liquidity drives the markets, so the logically answer is ‘yes’.

However, there are a few other variables.

-

U.S. QE was unleashed when the S&P 500 was near 12-year low. European QE was announced when German and English bourses are at or near all-time highs.

-

The situation in Europe is more fragmented and complex than in the U.S.

-

The U.S. dollar was at a multi-year high when U.S. QE was launched. The euro is at a 11-year low.

Despite all the differences, European QE was received similar to U.S. QE. Here’s what one German politician said:

“QE makes the rich even richer. It is a drug for the stock market. It drives up stocks. But the money should flow in the real economy, not banks.” Sounds familiar, doesn’t it.

Here are a few headlines commenting on the ECB’s move:

-

MarketWatch: Why European QE is bearish for US stocks

-

Fortune: Larry Summers: The ECB’s QE won’t work

-

FoxNews: Five reasons why ECB won’t save continents dying economies

U.S. stocks rallied for years despite all the persistent haters (me being one of them).

The stage seems set for a European stock rally.

However, the Vanguard FTSE Europe ETF (NYSEArca: VGK) cautions buyers against rushing in. VKG is about to the reach double technical resistance.

This doesn’t mean it can’t go higher, but buying before a speed bump is rarely prudent. A breakout would be a better reason to buy (and it would offer a good stop-loss level). The charts for five other European ETFs look similar. View Top 5 European ETFs here

What about the regions strongest stock index? Germany’s DAX is trading at all-time highs, and is about 3% above important support at 10,000. Further gains are possible, but a close below 10,000 would put the QE rally on hold.

Unfortunately there’s no ETF that closely tracks the German DAX. The iShares MSCI Germany ETF (NYSEArca: EWG) is severely lagging behind the DAX. Otherwise it would be interesting to buy EWG and short SPY (S&P 500 SPDR) or go long the DAX with a stop-loss just below 10,000.

The U.S. QE experiment has taught us that it’s foolish to bet against the Federal Reserve or its international counter parts … and yet I have a tough time believing that European stocks will take off right away.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|