The cat is out of the bag. The ECB will buy up to euro60 billion a month from March 2015 to September 2016. Purchased assets will include government bonds, debt securities by European institutions and private-sector bonds.

Why? Eurozone inflation is negative. Deflation is bad news, and pumping money (QE) into financial markets is hoped to fight deflation and spark inflation.

Inflation, by definition, erodes the value of a currency. The obvious conclusion; eurozone QE should send the euro lower.

But if something is too obvious, it can obviously be wrong.

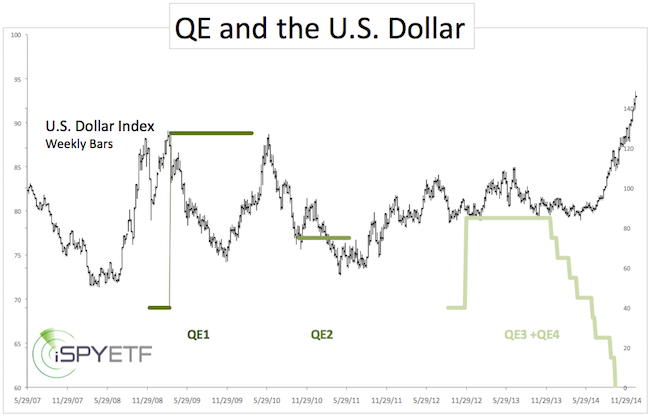

Let’s take a look at what U.S. QE did for the U.S. dollar.

The chart below plots the U.S. Dollar Index against the various QE programs.

QE1 saw wild dollar swings, but no discernable down side bias. In fact, the dollar rallied when QE first started.

QE2 didn’t sink the dollar either and the greenback actually rallied during QE3/4.

Headlines like ‘Why quantitative easing is likely to trigger a collapse of the U.S. Dollar’ proved incorrect.

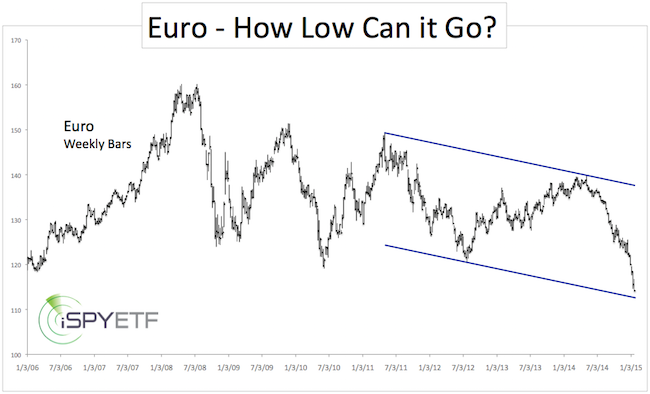

The euro lost 18% since May 2014. This is one of the most pronounced declines in recent history.

In 2008 the euro lost 23.1% before bouncing back, in 2009/10 21.5%. Technical support for the euro is not far below current trade, so shorting the euro is akin to picking up pennies in front of a train.

Contrary to conventional wisdom, investors should put the CurrencyShares Euro ETF (NYSEArca: FXE) on their shopping list and start exiting the PowerShares DB US Dollar Bullish ETF (NYSEArca: UUP).

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|