-

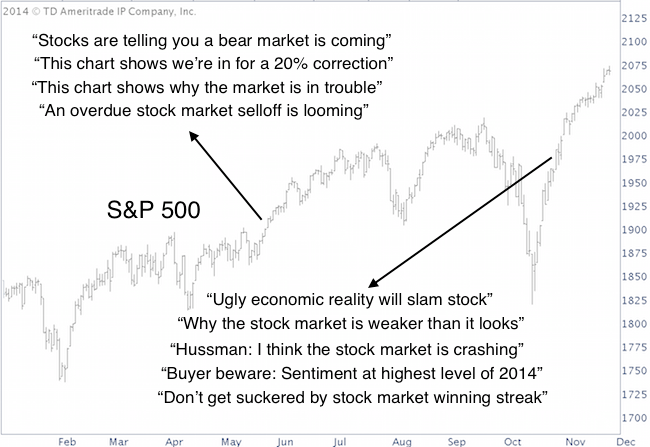

“This chart says we’re in for a 20% correction”

-

“An overdue stock market selloff is looming”

-

“Stocks are telling you a bear market is coming”

-

“This chart shows why the market is in trouble”

Before you call me a fear monger, allow me to clarify that those headlines are from May 2014.

As it turns out, whatever stocks or charts were ‘telling’ us, wasn’t the truth. It probably wasn’t as much of a stock market lie, than the media getting the signals wrong. There was no bear market, no 20% correction and no real ‘trouble.’

Here are more recent headlines:

-

“Buyer beware? Investor sentiment at highest level of 2014”

-

“Why the stock market is weaker than it looks”

-

“Are you prepared if the market tanks in Q4?”

-

“Don’t get suckered by stock market winning streak”

Purely based on the second set of headlines, I wrote in the November 5 Profit Radar Report:

“Media attention on bullish sentiment could be a contrarian contrarian (two negatives make a positive) indicator and actually be net positive. Investment advisors and newsletter-writing colleagues (polled by Investors Intelligence) are embracing this rally. The percentage of bulls has soared from 35.3% on October 21 to 54.60%. This is the largest jump in nearly 40 years. Perhaps surprisingly, this is not as contrarian a signal as it appears. Furthermore, advisor optimism is somewhat neutralized by media pessimism and headlines such as: “This stock market rally is for suckers” – MarketWatch and “Don’t buy into stock market craziness” – CNBC. Media bearishness is not as extreme as it was in May/June, but it may be significant enough to continue propelling stocks higher.”

Too much success is the worst thing that can happen to a contrarian indicator (such as investor sentiment).

Complex Analysis Made Easy - Sign Up for the FREE iSPYETF E-Newsletter

A contrarian indicator with mainstream appeal loses its effectiveness, just like a rare commodity that’s suddenly available in abundance (imagine what would happen to gold prices if everyone suddenly found a couple pounds of the yellow metal in their backyard).

The Profit Radar Report not only monitors dozens of sentiment indicators, it also gauges media exposure of any specific indicator and media sentiment in general.

Fortunately, media sentiment has been one of the most accurate indicators of the year. This indicator remains so right, because cover stories tend to be so wrong.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|