Here is an issue of national importance: A chocolate shortage.

“The world could be heading toward a global shortage of chocolate” – Time

“Cocoa shortage worries chocolate lovers” – NBC News

“Worlds largest chocolate manufacturer warns of potential cocoa shortage” – The Independent

“Is a chocolate shortage on the way” – USA Today

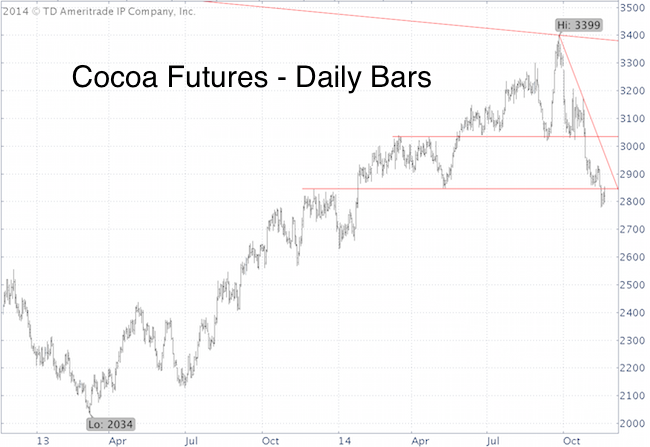

The price of cocoa soared 67% from March 2013 to September 2014.

Mars, the makers of M&M’s and Snickers, announced in July it would raise prices by an average of 7%.

However, since September, cocoa prices have fallen 17%.

Is this drop an opportunity to invest in cocoa or is the cocoa shortage all hype?

Complex Analysis Made Easy - Sign Up for the FREE iSPYETF E-Newsletter

There are legitimate reasons for cocoa demand to outstrip supply:

-

Dry weather in West Africa. Africa is responsible for 70% of the world’s production

-

Deadly fungi like frosty pod and witches’ broom

-

A growing taste for chocolate by emerging countries

-

Ebola

We’ve seen a number of commodity ‘shortages’ in recent years. There was corn (ethanol as alternative fuel source) and wheat. Both are trading at or near multi-year lows today.

Based on the current media hype, I wouldn’t be surprised to see a bit more cocoa weakness.

The chart says that cocoa prices need to exceed 2,845 (that’s $2,845 a ton) and the descending red trend line to break the most recent down trend.

There are two cocoa ETF/ETNs:

-

iPath Dow Jones-AIG Cocoa Total Return Sub-Index ETF (NYSEArca: NIB)

-

iPath Pure Beta Cocoa (NYSEArca: CHOC)

Perhaps the Federal Reserve will unleash a quantitative eating program to increase liquidity. After all, Wall Street is a big consumer of cocoa, especially around the holidays.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|