Do you remember the term ‘green shoot’? Unfortunately we can't talk about 'green shoots' without bringing up Bernanke.

Bernanke coined the term (or repurposed its meaning) about four years ago to convey the idea of a painfully slow economic recovery.

Bernanke’s ‘green shot’ assessment was met by much skepticism.

One of the indicators bears, short sellers, skeptics and pessimists used to support the notion of a relapse was the Baltic Dry Index (BDI).

I know, because throughout 2010 I was one of those skeptics (although I gave a big fat buy signal via my March 6, 2009 Profit Radar Report update).

The rational went something like this: How could the global economy be improving if global shipping rates continue to deteriorate? After all, slowing demand for shipping means slowing demand for goods of all sorts. If the consumer isn't consuming how can the economy grow?

The reasoning made sense at the time … but was shattered by the endless S&P 500 (SNP: ^GSPC) rally.

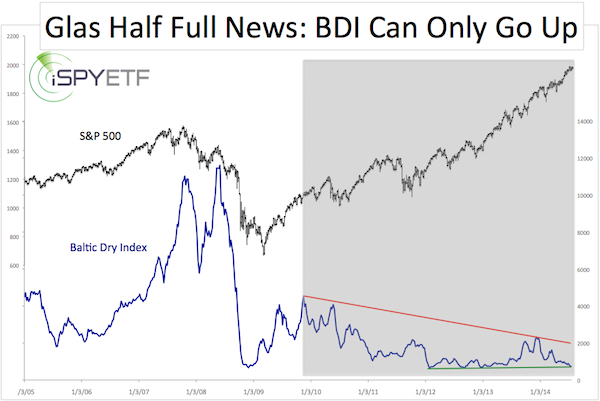

The ‘flash from the past’ chart below plots the Baltic Dry Index against the S&P 500.

The BDI continues to make progress towards its all-time low, while the S&P 500 (NYSEArca: SPY) hops from one all-time high to the next.

Obviously it doesn’t make sense to build any kind of forward-looking S&P 500 analysis around the BDI (as for as the BDI goes, one might say it has nowhere to go but up).

The moral of the story is that no type of fundamental analysis, regardless of how much sense it makes, is infallible.

In the spirit of ‘given enough time, we’ll all be wrong,’ you may enjoy reading about how wrong the media has been for the past few months.

In fact, an indicator built around media bloopers is perhaps the only indicator to predict this relentless S&P 500 rally. More funny, yet disturbing details here:

The Only Indicator That Foresaw a Persistent S&P 500 Rally With No Correction

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|