Gold jumped 3.26% on Thursday, the biggest one-day gain of 2014. Ironically, such a display of gold's strength is short-term bearish for the S&P 500.

Since the beginning of the post-2009 QE bull market, there’ve been three prior occasions when gold staged the biggest move of the past six months, while the S&P 500 (SNP: ^GSPC) traded at new 1-year highs.

All three instances are illustrated via the charts below:

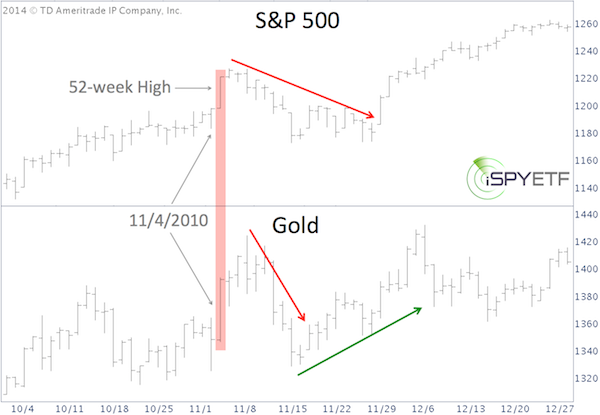

November 4, 2010:

S&P 500 pulled back immediately.

Gold staged a minor pullback a few days later before moving higher.

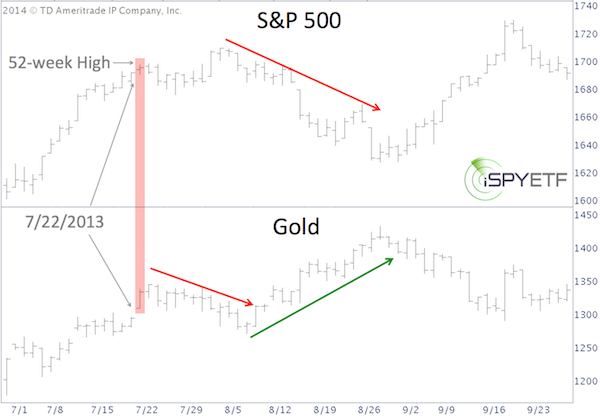

July 22, 2013:

S&P 500 grinded higher for a few more days before a multi-week correction.

Gold meandered sideways/down.

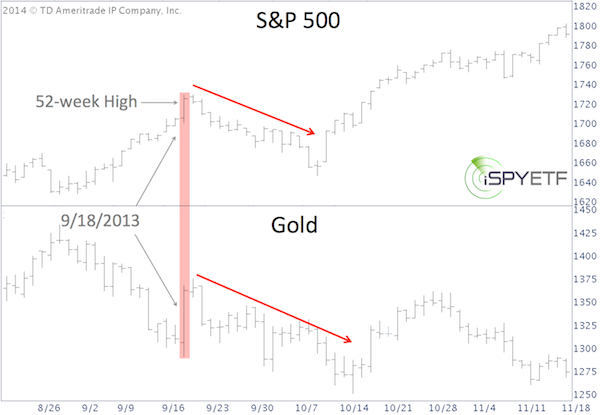

September 18, 2013:

S&P 500 and gold pulled back immediately.

Gold’s performance is in line with what the Profit Radar Report proposed on May 28: “Gold broke out of the triangle and is approaching a general support zone at 1,255 – 1,230. A bounce from this zone to about 1,330 is quite possible.”

Thus far in June, gold bounced from 1,238 to 1,322.

Based on gold seasonality a bottom for gold may be in. But gold cycles and the lack of a real washout selloff suggest another new low.

Silver cycles are a bit more bullish than gold, that’s why the June 15 Profit Radar Report recommended to buy silver at 19.6 (silver spiked as high as 20.1 today).

Summary

Gold is getting closer to its initial up side target around 1,330 and the S&P 500 is at the up side target (1,954) projected by the Profit Radar Report back in January.

It’s too early to panic sell, but risk for gold and gold ETFs like the SPDR Gold Shares (NYSEArca: GLD) and the S&P 500 (NYSEArca: SPY) is rising.

Why is S&P 1,954 so important? Here’s why the Profit Radar Report pegged 1,954 back on January 15, 2014.

2014 S&P 500 Forecast

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|