Even before this year's earnings ritual started, a number of companies spoiled the third quarter earnings season. Intel, Caterpillar, FedEx and many others warned that estimates were too high.

Bloomberg reported that earnings pessimism among U.S. chief execs is the highest since the 2008 meltdown and the Wall Street Journal warns of an “earnings pothole.”

The S&P 500 has rallied as much as 37% since the October 2011 low and the stock rally has become extended. Could a bad earnings season push stocks off the edge?

De-focus On Earnings

Earnings are just one of many forces that drive stocks, in fact I consider them secondary and to some extent a contrarian indicator. Record high Q1 2010, Q1 2011, and Q1 2012 earnings were followed by dismal short-term stock performance so disappointing Q3 2012 earnings don’t automatically translate into falling stock prices.

Seasonality is favorable for most of the remaining year and key technical support for the S&P 500, Dow Jones and even the Nasdaq-100 is holding up. Let’s take a closer look at the S&P 500’s technical picture.

Since June the S&P has been climbing higher within the black parallel trend channel. The S&P’s rally stopped at 1,474.51 on September 14, which was exactly when the upper parallel channel line converged with a decade old resistance line.

Ironically that was just one day after Bernanke promised unlimited QE3. They say don’t fight the Fed, but in this instance the Fed lost to technical resistance. The decline from the September 14 high helped digest overly optimistic sentiment and put the trading odds in favor of going long.

The October 7, Profit Radar Report cautioned of lower prices, but viewed any decline as an opportunity to go long: “A digestive period that draws the S&P to 1,450 and perhaps towards 1,420 seems likely. The highest probability trade is a buy signal triggered by a move below the lower black channel line (around 1,420), followed by a move back above.”

Using trend lines to identify buying or selling opportunities worked like a charm in 2010 and 2011 (trend line breaks were a major contributor to short recommendations in April 2010 and May 2011), but starting in 2012 the S&P delivered a number a fake trend line breaks.

That’s why the above recommendation was to wait for a break below trend line support followed by a move back above before buying. The strategy worked. From here we simply elevate the stop-loss to guarantee a winning trade. We will go short only if the next important support is broken.

Long-term Earnings Message

Even as the economy continues to deteriorate, corporate earnings have slowly crept to new all-time highs. That’s right, all-time record highs.

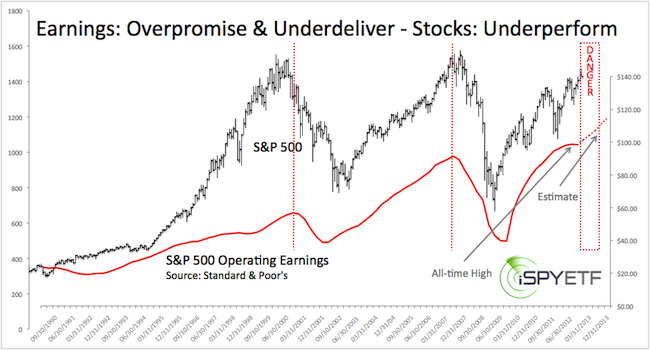

The chart below plots operating earnings for S&P 500 companies (as reported by Standard & Poor’s) against the S&P 500 Index. Corporate earnings are the epitome of a mean reverting indicator and as predictable as a boomerang.

Every time corporate earnings get too high they reverse and the boomerang hits stocks. Nobody knows how high is too high. Right now, too many are expecting the boomerang to hit so it may take a bit longer, but we’re getting there.

Summary

Over the short-term (possibly into Q1 or Q2 2013) stocks may continue to rally (despite disappointing Q3 2012 earnings), but the long-term implications of record high earnings are deeply bearish for stocks.

The short-term opportunity for investors is to buy the SPDR S&P 500 ETF (SPY) on pullbacks (as long as they remain above key support). I don’t have a specific up side price target, but we’ll take profits when we see bearish technical divergences.

Concurrently we’ll be watching for a market top. Unfortunately, market tops aren’t a one-time event, it’s a process. Like knocking over a Coke machine, you have to rock it back and forth a few times before it falls over.

We’ll be looking at ETFs like the Short S&P 500 ProShares (SH) and UltraShort S&P 500 ProShares (SDS) once we see bearish divergences confirmed by sentiment and seasonality.

The Profit Radar Report will identify low-risk and high probability buying opportunities when they present themselves.

|