Baron Rothschild’s famous adage, that the time to buy is ‘when there’s blood in the streets', is timeless.

History has also shown that the old adage is reversible, meaning that the time to sell is when there’s no sight of ‘blood in the streets’ or extreme optimism.

Is there extreme optimism right now?

Allow me to introduce my very own, non-scientific media sentiment indicator.

A couple of weeks ago value investing icon Jeremy Grantham published his first quarter 2014 newsletter. The topic was a statistical approach to market bubbles.

The Glass Half Empty Interpretation

According to the letter, Grantham believes that the S&P 500 will form a bubble that will eventually burst. The conclusion in his words is as follows:

“But I believe it [the bubble] will not end for at least a year or two and probably not before it reaches a level in excess of 2,250 on the S&P 500 (SNP: ^GSPC). I am not saying that this time is different. I am sure it will end badly.”

The financial media (not sure if they read the entire report or not) spun the following headlines out of Mr. Grantham’s analysis:

“Jeremy Grantham on Bubbles: ‘I am sure it will end badly’” – Wall Street Journal

“Jeremy Grantham: Stocks set to crash around November 2016” – Moneynews

“When Jeremy Grantham sees bubbles, it’s worth paying attention” – The Globe and Mail

“Jeremy Grantham makes a very specific call about when the bubble will burst” – Business Insider

This may have gotten lost in translation, but Grantham ‘predicted’ two developments:

-

The S&P 500 will rally to 2,250

-

It will end badly

Yet, I could not find a single article that even mentioned, let alone highlighted, S&P 2,250, which is a pretty bold call.

In fact, bearish financial headlines were so pervasive in early May that Yahoo Breakout ran a segment called: “The boys who cried wolf: Crash prophets on the rise.”

Is someone (hint: media) trying to spill blood on the street?

It Happened Before

This environment reminds me of what we saw about a year ago, when I wrote in the March 10 Profit Radar Report that:

“The Dow surpassed its 2007 high and set a new all-time high last week, but investors seem to embrace this rally only begrudgingly and the media is quick to point that stocks are only up because of the Fed. We know this is a phony rally, but so does everyone else. We know this will probably end badly eventually, but so does everyone else. The market likes to fool as many as possible and it seems that overall further gains would befuddle the greater number.”

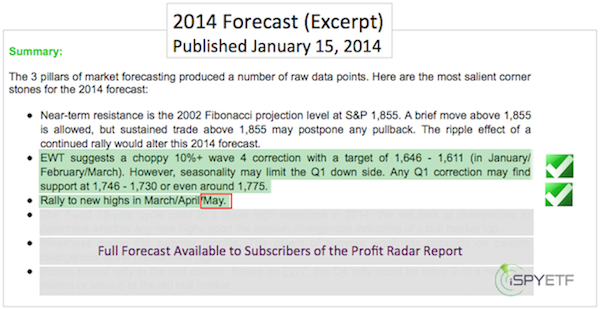

My research (S&P 500 2014 Forecast, published on January 15, 2014, available to subscribers of the Profit Radar Report) proposed a rally towards S&P 1,950 followed by a 10%+ correction back in January.

However, the recent spell of bearish headlines (caused by sideways trading not a correction) made me suspicious. It was time for the market to fool the crowded trade again. I proposed this head fake scenario in the May 7 Profit Radar Report (S&P was as low as 1,860 that day):

“The weight of evidence suggests the onset of a larger correction in May, but we are not the only ones expecting a correction. A false pop to 1,900 – 1,915 would shake out the weak bears and set up a better opportunity to go short.”

We got an S&P 500 (NYSEArca: SPY) pop to 1,902.17 on May 13, but the headlines continue to be bearish. We’ll have to see if the pop was enough to fool the bears and set the stage for a deeper correction.

I will be looking at key support and resistance levels for valuable directional clues.

The most important near-term support/resistance levels are disclosed here for free:

S&P 500 Analysis: The ‘Chopping Zone’ Explained

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|