Investors are scrambling for two things right now: Safety and income.

Safety

Courtesy of the 2008 meltdown stocks lost about 50% and even the persistent stock market rally from the March 2009 low is marred by three corrections of 10 – 20%. Such drops aren’t easy to stomach and retail investors are simply scared of volatility.

Income

The Federal Reserve has publicly stated its objective of keeping interest rates low until 2015 and beyond. This is great for banks and corporations, but investors (especially retirees) are left without income.

The need for income draws many to dividend ETFs. The common perception is that dividend ETFs provide safety and income, but is that really true? Let’s look at the facts.

Dividend ETFs

We will use the iShares Dow Jones Select Dividend ETF (DVY), SPDR S&P Dividend ETF (SDY), and Vanguard Value ETF (VTV) as proxy for dividend ETFs. The current dividend yields are: 3.41% for DVY, 3.14% for SDY, and 2.61% for VTV.

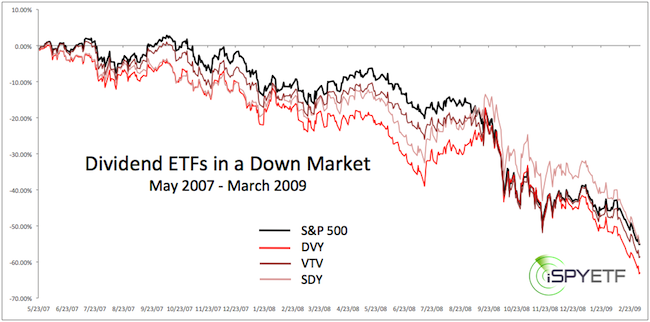

DVY, SDY, and VTV reached their all-time high on May 23, 2007. How did DVY, SDY and VTV handle the 2007 – 2009 stock market crash compared to the S&P 500?

From May 23, 2007 – March 06, 2009 the S&P 500 lost 55.11%. Surely, dividend ETFs should have fared much better, right? Wrong! DVY lost 63.01%, VTV lost 58.59% and SDY slightly “outperformed” the S&P with a loss of “only” 54.83% (see chart below).

Financial Sector – For Better and for Worse

One reason dividend ETFs got slammed by the market crash is their objective of finding dividend paying stocks. The financial sector paid the highest dividends in 2007, 2008, and early 2009.

Financial stocks got hit harder than the broad market. Being focused on dividends during this time was like maxing out your credit card just to earn miles. The cost (or risk) simply wasn’t worth the benefit (or dividend).

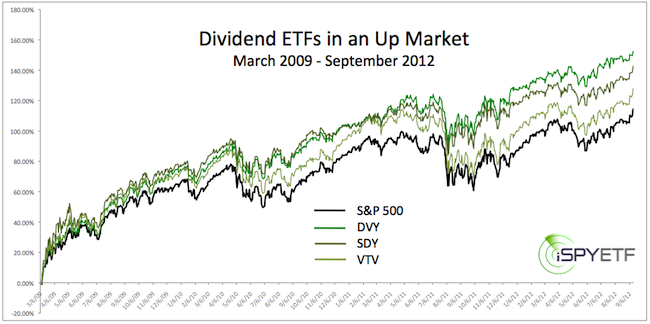

Nevertheless, the exposure to financial stocks helped dividend ETFs to a quick recovery in 2009. Although dividend ETFs did a lousy job of preserving their owners capital during the meltdown, they’ve outperformed the S&P ever since.

Sector Rotation

From the March 2009 low to the September 14, 2012 high, the S&P 500 was up 114%, DVY gained a stunning 152%, SDY 143%, and VTV 128% (see chart below).

DVY and SDY also did better during the summer 2011 meltdown. Where the S&P 500 lost as much as 21.58%, DVY’s maximum loss was 17.78% and SDY dropped not more than 17.90%. VTV on the other hand fell a whopping 24.30%.

We don’t know the ETF’s top holdings in 2011, but today VTV is the only ETF that still counts financials as its top sector. This probably contributed to the disappointing performance in 2011 (financials lost as much as 36.33% in 2011).

SDY has a 21% stake in consumer staples, which paid off as the SPDR Consumer Staples ETF (XLP) now trades over 20% above its 2007 high. DVY has a 31% stake in utilities and 18% exposure to consumer goods.

Lessons Learned

Who would have thought that dividend ETFs outperform the S&P in an up market and under perform in a down market? Dividend ETFs aren’t bad investment options, but they may not do what “they’re supposed to do.”

Chasing dividend yield rich sectors bears risks, and if you own dividend ETFs solely as a protection against the next sell off, you may want to rethink your strategy.

|