Gradualism is a slow change, and changes in slow stages are less shocking than sudden changes.

Case in point, today’s and Friday’s big Nasdaq drop is getting a lot more attention than last month’s slow Nasdaq deterioration.

The gradual stair-step lower has now accelerated into a 6%+ correction for the Nasdaq QQQ ETF (Nasdaq: QQQ).

But the warning signs started as early as January. On January 5, the Profit Radar Report featured this warning commentary:

“Trivia: Which high-flying tech leader has a P/E ratio of 1,403? Tip: This stock is the fourth biggest component of the Nasdaq-100. Answer: Amazon (AMZN). Amazon founder Jeff Bezos is a true visionary and Amazon is working on amazing technology, but ultimately earnings are more important than pure vision. Near-term support is around 380. A close below 380 would open the door for much lower targets.”

The February 2 Profit Radar Report included the following update on Amazon and a shocking new warning for Google.

Here’s the Amazon update: “Amazon gapped below support at 380 on Friday, unlocking a potential target around 340 or 320. Resistance is not at 380, which would be a low-risk entry to go short for aggressive investors.”

Here’s the shocking (at the time) February 2 Google warning:

“Better than expected Google earnings propelled the stock to trend line resistance. This may be the end of the rope for Google and an opportunity to leg into a strategy that profits from lower prices (short GOOG, buy GOOG puts or sell GOOG calls). Support is around 1090.

Fishing for tops of high-flying tech companies is risky business, but can pay off big (i.e. short AAPL, see recommendation in Sep. 12, 2012 Profit Radar Report). GOOG is over-loved (the timing to issue lower-priced shares could be indicative of a top), cycles point lower and RSI is lagging prices. Nevertheless, strong momentum can overwrite bearish forces for a while. Legging into short positions at various prices reduces the risk of catching a falling knife.”

The recommended Amazon and Google put options are up 100 – 300%, but more importantly Amazon.com (Nasdaq: AMZN) and Google Inc. (Nasdaq: GOOGL) account for over 10% of the Nasdaq-100 and therefore foreshadowed a period of Nasdaq underperformance.

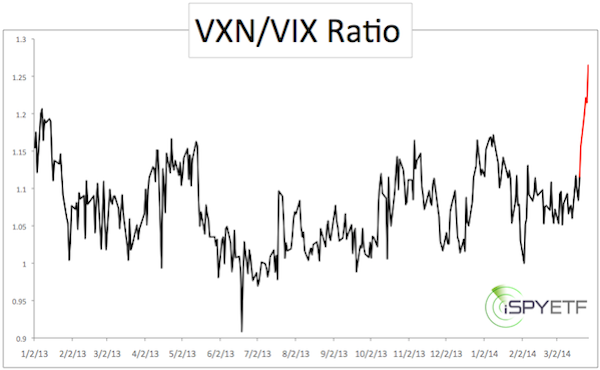

A March 31 examination of the Nasdaq VIX (VXN) compared to the S&P 500 VIX (VIX) showed increased fear about Nasdaq stocks (see chart below published on March 31).

This fear of holding the hottest tech names became more obvious in early April when ‘old tech’ names like Microsoft, Oracle, CSCO and Intel smoked ‘new hot tech’ names like Facebook, Tesla, Netflix and Priceline (click here for April 2 article: “Why ‘Hot New Tech’ is Getting Crushed by ‘Old Tech’).

Although it may seem like it, the Profit Radar Report is not a stock picking service. The Profit Radar Report’s focus is forecasting movements for the S&P 500 (and at times Nasdaq and Dow Jones).

But sometimes certain stocks get too ‘bubblelicious’ to ignore (and serve as early warning indicators for broad indexes).

As far as the S&P 500 (SNP: ^GSPC) is concerned, one deceptively simple chart that warned of an S&P 500 top around 1,900 was published here on April 1 (important detail: The chart also highlights key support).

S&P 500 Stuck Between Triple Top and Triple Bottom

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|