“Copper awaits further decline on global economic worries” was one of many copper-related headlines on and around March 18.

Financial reporting makes it appear as if anything ‘Dr. Copper’ does has either an effect on the economy or the S&P 500.

We’ll show later that this isn’t the case, but there’s hope for all the ‘sell everything because copper is down’ doomsday sayers. Why?

Because the smart money is gobbling up copper.

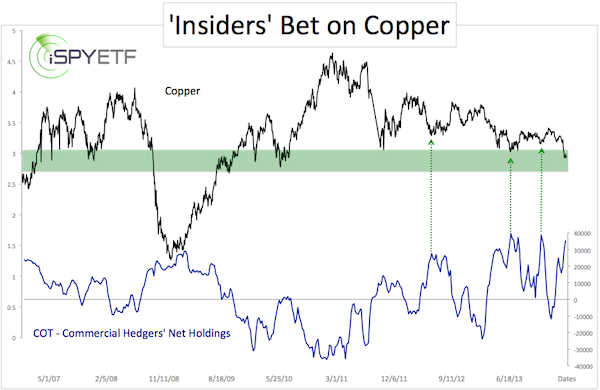

The chart below plots copper prices against the number of copper futures contracts held by commercial hedgers (data source: Commitment of Traders Report – COT).

Commercial hedgers include copper miners and distributors. They are considered the ‘smart money’ because they are actually involved in the copper trade.

Commercial hedgers have rarely shown more desire to own copper.

That should be good for copper prices, as long as support holds.

What does this mean for stocks in general and the S&P 500 (SNP: ^GSPC) in particular?

Here is a detailed analysis of the correlation between the S&P 500 (NYSEArca: SPY) and copper, along with an important near-term support level for copper: Is Copper Really a Leading Indicator for the S&P 500?

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|