If you’ve read my commentary before, you know that I religiously follow the ‘3 pillars of market forecasting.’

-

Technical analysis

-

Sentiment

-

Seasonality & Cycles

Each of the 3 pillars is subdivided into many more specific indicators.

I apply the 3 pillars to all asset classes analysis, which includes the S&P 500 (SNP: ^GSPC), gold, silver, euro, dollar, Treasuries and occasional looks at specific sectors, or stocks (such as going short AAPL in September 2012).

The 3 pillars don’t necessarily produce many signals. For example, gold sentiment was red hot in mid-2012 (when we recommended to sell gold) and quite bearish several weeks ago, but there weren’t any real extremes in between.

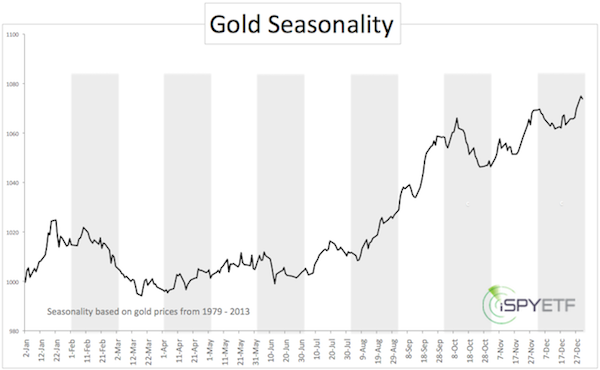

Gold seasonality only projects three or four good buy/sell signals per year, one just happened in late January.

Shown below is the only updated gold seasonality chart available on the web. The pattern is based on gold price history from 1979 – 2013.

The January 26 Profit Radar Report featured the above chart and warned that: “Seasonality suggests gold may get into trouble right about now.”

Seasonality applies to the major gold ETFs such as the SPDR Gold Shares (NYSEArca: GLD) and iShares Gold Trust (NYSEArca: IAU), as well as short gold ETFs like the UltraShort Gold ProShares (NYSEArca: GLL).

As mentioned earlier, seasonality is only one piece of the market analysis/forecasting puzzle.

Technical analysis is another one, and right now is at least as important as seasonality.

In fact, the gold chart (part of technical analysis) displays a crystal clear picture and delineation between bullish potential and bearish risk.

An intriguing look at the technical gold picture along with a long-term outlook is available here:

Are Gold and Silver Revving up for Another Leg Down?

If you are interested in S&P 500 seasonality, you may enjoy the juicy nugget of information discussed here:

Reliable Seasonal Pattern Shows 73% Probability 2014 Will be a Bad Year for S&P 500

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|