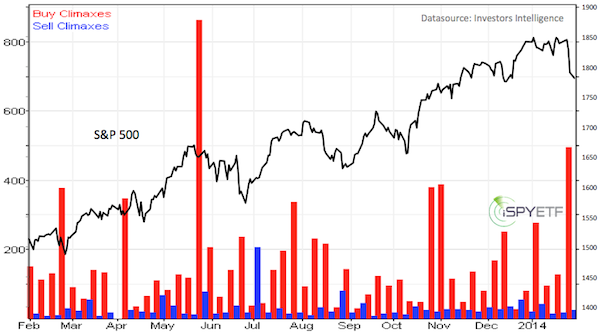

90 S&P 500 component stocks saw a buying climax last week.

That means that 18% of all S&P 500 (SNP: ^GSPC) stocks made a 12-month high last week, but ended the week with a loss.

More S&P 500 buying climaxes were only seen three times in the last decade (November 2004, April 2010, May 2013).

22% of Nasdaq-100 (Nasdaq: QQQ) companies also saw a buying climax. Some of the more popular Nasdaq reversal stocks include high-flying Amazon and Priceline.

Investor’s Intelligence reported 495 NYSE buying climaxes.

The chart below plots the number of buying climaxes reported by Investors Intelligence against the S&P 500 Index.

Historically, the S&P 500 (NYSEArca: SPY) and Nasdaq have rarely been as overbought as in December/January.

The high amount of buying climaxes caution that the smart money is exiting while the not-so-smart money has come late to the party.

Buying climaxes are one reason to worry about a deeper correction. Here are three others:

Watch for a Bounce! But 3 Reasons Why a Longer Correction is Likely

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|