It’s been almost five years since the financial collapse and we have yet to see somebody from Wall Street go to jail.

How come?

Big bank banksters gladly participate in the governments “cash for time” program (government to banks: “Give us cash and you won’t do time”).

Since 2010, JPMorgan (NYSEA: JPM) alone has paid $27.2 billion in fines (below is a list of fines compiled by Larry Levine. If you don’t have time to read this long list, skip to the fascination conclusion towards the bottom of the page).

• June 2010: $48.6 million fine – Commingling JPM and client funds in London.

• April 2011: $56 million fine - Overcharging or wrongfully foreclosing on active-duty military personnel.

• June 2011: $153.6 million fine – Failed to inform buyers of CDOs it sold that a hedge fund assisted picking and bet against those CDOs.

• July 2011: $228 million – Fraudulently rigged at least 93 municipal bond transactions in 31 states.

• August 2011: $88.3 million fine – Conducted transactions with people or entities tied to Iran, Sudan, Cuba, and Liberia.

• February 2012: $5.29 BILLION fine – Settled what was called years of “shoddy loan servicing, illegal robo-signing, and faulty foreclosure processing.”

• February 2012: $110 million fine – Charged unwarranted overdraft fees.

• March 2012: $150 million fine – Settled with pension funds and other investors for post-2008 shady investment deals.

• April 2012: $20 million – Improperly extended credit to Lehman Brothers based in part on customer funds that were required to be kept separate.

• August 2012: $1.2 billion – Conspired to set the price of credit and debit card interchange fees.

• November 2012: $296.9 million fine – Misleading investors about the quality of mortgages that underlay mortgage-backed securities it sold.

• January 2013: $1.8 BILLION fine – Fined over “robo-signing” and other alleged abuses of the foreclosure process.

• March 2013: $100 million fine – Mishandling of the MF Global account that went bankrupt thanks to Jon Corzine, who is also not in jail.

• July 2013: $410 million fine – Manipulating energy prices!

• Sept. 2013: $389 million – Unfair billing practices (2.1 mln customers) that charged for credit monitoring services they did not receive.

• Sept. 2013: $920 million – The "London Whale" disaster clearly broke many rules and regulations that JPM ignores.

• Sept. 2013: $13 BILLION – Record deal to end U.S. probes of its mortgage-bond sales.

• Jan 2014: $2.6 BILLION – Acknowledged that it ignored red flags for about 15 years that Madoff used his account to run a fraud!

• Jan 2014: $350 million – Widespread deficiencies in the bank’s BSA and anti-money laundering compliance programs.

It’s Not All Bad for Banks

JPMorgans 2013 profit is around $17 billion. Breaking the law must be essential for JPMorgan’s bottom line if it’s worth sacrificing 1.5X annual profit in fines.

Legal expenses for the six big U.S. banks - JPMorgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley – amounted to roughly $24 billion in 2013.

But not all is bad for banks. Last year’s combined profits of the six largest U.S. banks was $74.1 billion, the highest level since 2006.

And possibly even more important, the statute of limitations (five years for securities fraud) for many federal offenses is about to expire soon … quite possibly without any real convictions.

Financial Sector Myths & Facts

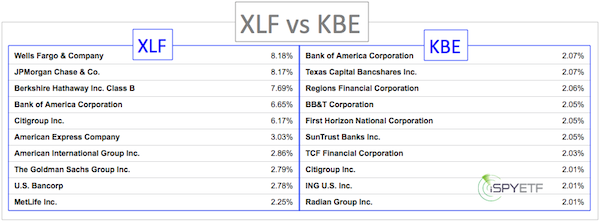

The six big U.S. banks - JPMorgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley– account for over a third of the Financial Select Sector SPDR ETF (NYSEArca: XLF).

Contrary to common perception, the four biggest banks account for only 8% of the SPDR S&P Bank ETF (NYSEArca: KBE). Goldman Sachs and Morgan Stanley are not even included in the KBE Bank ETF.

Financials are the second biggest sector of the S&P 500 and account for 16.36% of the S&P 500 ETF (NYSEArca: SPY).

In addition to legal fees, the financial sector has to fight with technical resistance. As the XLF chart on top shows, this resistance is created by the 50% Fibonacci retracement of the points lost from the 2007 high to the 2009 low.

As the list of JPMorgan fines above shows, U.S. banks are happy to pay the fines caused by various versions of insider trading (the profit must be worth it).

Insider trading is tabu for mortal investors. Or is it? A new report highlights insider trading techniques legally available to everyone.

Insider Trading Just Became Legal

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|