Charles Evans is the ninth president and chief executive officer of the Federal Reserve Bank of Chicago.

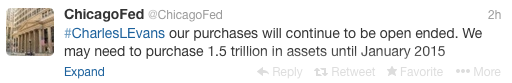

He tweeted the following on Tuesday, November 19:

“Our purchases will continue to be open ended. We may need to purchase 1.5 trillion in assets until January 2015”

As a Federal Reserve president Mr. Evens is fluent in the art of sending cryptic messages. The above tweet is no different.

Deciphering the Modern Day Enigma

What could Mr. Evans have meant?

Currently the Federal Reserve is buying $85 billion worth of assets per month. That’s $1.02 trillion per year or $1.19 trillion until January 2015.

Going from the current pace of $1.19 trillion to $1.5 trillion in asset purchases is an increase of 26%.

Is Mr. Evans saying that the Fed may have to further beef up QE?

Enough to Buy 8% of ALL U.S. Stocks Every Year

$1.5 trillion is an incredible amount of money. How incredible?

According to the World Bank, the total market capitalization of the U.S. stock market was $18.67 trillion in 2012. Total market cap includes the S&P 500 (SNP: ^GSPC), Dow Jones (DJI: ^DJI), and every other U.S. index you can think of.

$1.5 trillion is enough to buy 8% of all U.S. traded stocks. No wonder the S&P 500 and Dow Jones have nowhere to go but up.

Comparing the Fed’s current $4 trillion balance sheet with the total U.S. market cap (projected to be $21.4 trillion in 2013) almost allows the conclusion that the Federal Reserve conceivably financed 17% of all U.S. stock purchases.

When considering the size of the Fed’s balance sheet and active purchases in correlation to the total U.S. stock market, it seems almost inconceivable for the S&P 500 ETF (NYSEArca: SPY), Dow Jones Diamonds ETF (NYSEArca: DIA) and any other broad market ETF or index to catch a sustainable down draft.

Media Omission May Solve The 'Evans Enigma'

There is another explanation for the $1.5 trillion ‘Evans Enigma.’

The Federal Reserve is already buying more than $85 billion worth of assets every single month, but the financial media largely omits the real scope of all QE-like programs. How much is the Federal Reserve really spending every single month?

A detailed analysis along with a simple one-chart visual summary of all of the Federal Reserve’s QE-like programs can be found here:

Glaring but Misunderstood QE – How Much the Fed is Really Spending

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report uses technical analysis, dozens of investor sentiment gauges, seasonal patterns and a healthy portion of common sense to spot low-risk, high probability trades (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|