Sometimes not doing anything is the best thing you can do.

Investors who’ve been sitting on their hands (and portfolio) since 2009 must be quite happy. Ignorance has been bliss.

In 2007 however, there was no bliss in ignorance. Those who got caught up in the general spirit of complacency got a rude wake up call. You snooze you lose (literally).

By some measures, investor sentiment has reached a level similar to 2007.

Is now the time to stop snoozing or continue to be ignorant?

The Case for ‘Stop Snoozing’

Aside from a few minor glitches, the S&P 500 (SNP: ^GSPC) has been on a tear for much of 2013.

The S&P 500 is now trading 12% above its prior 2007 high. Until a few weeks ago investors felt largely indifferent about the continual streak of new all-time highs.

But now optimistic sentiment extremes are popping up all over the place.

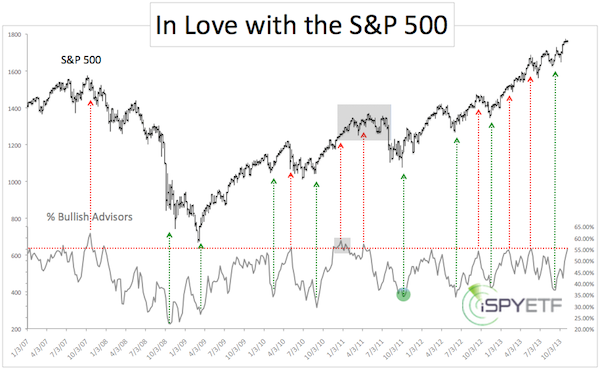

We don’t have enough space to discuss all of them here, but the S&P 500 / investment advisor sentiment chart below is a nice proxy of investor enthusiasm.

The chart simply plots the S&P 500 against the percentage of bullish investment advisors and newsletter-writing colleagues.

Another largely unpublicized, but extremely accurate contrarian sentiment gauge is discussed here: Largely Unknown but Accurate Gauge Shows Stocks are Overvalued

The Case for ‘Stay Ignorant’

Let’s be clear about this: Sentiment is at an optimistic extreme and under normal condition I would not go long.

However, I’ve observed another curious albeit non-scientific sentiment development: The response of readers to financial commentary.

When I publish bullish articles, they are met by crickets, while bearish articles receive much more praise. Once again, this isn’t measurably scientific, but shows that sentiment may not be as stretched as various indicators suggests.

Since reaching my long-term up side target (published in various issues of the Profit Radar Report) of 1,760, the S&P 500 hasn’t gone anywhere.

Perhaps the ‘gone nowhere’ action is enough to work off an overbought condition and launch another rally leg (an overbought condition can be relieved by price or time). However, I trust the up side as little as I fear the down side.

Here’s how I intend to navigate the coming days (weeks?): If the S&P 500 moves above my up side trigger level (And only then. Trigger level is discussed in the Profit Radar Report) we will go long with a relatively small position – the easiest way to do this is via the SPDR S&P 500 ETF (NYSEArca: SPY). Those wanting more bang for their buck may use the ProShares Ultra S&P 500 ETF (NYSEArca: SSO).

Due to sentiment the up side is tricky, so tight stop-loss protection will be recommended.

Only a drop below support (or a move to my next target level) will have us considering going short.

My most recent free S&P 500 analysis includes more of my thoughts on the S&P 500 (from a technical point of view).

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|