Here’s a new twist: The government shutdown actually benefits the parties causing the stalemate.

American Public Media’s Marketplace.org reports that Democrats and Republicans profit financially from their fruitless debating. How so?

The Democratic National Committee (DNC) says it raised a record-breaking $2 million from Friday to Monday. Much of the money came from first-time donors. “It was the biggest fundraising day since before the 2012 election,” said Mo Elleithee, spokesman of the DNC.

Republicans aren’t happy about the Democrats fundraising windfall. Kirsten Kubowski, press secretary of the Republican National Committee (RNC), commented:

“We’re wondering if the reason they’ve refused to come to the table over the last couple of days is because they feel like they’re getting something out of it monetarily.” Ouch!

Somebody please tell Mrs. Kubowski that you shouldn’t throw stones while sitting in a glass house.

As it turns out, and by Kubowski’s admission, the RNC has raised over $1 million since Monday morning and has seen a great response on the government shutdown and on Obamacare.

According to Stephen Smith, a political scientist at Washington University, the donation windfall didn’t just happen. Both parties deliberately prepared to take advantage of this situation with mailings, e-mails and websites ready to capture the donations.

Unlike the official Obamacare health insurance website (healthcare.gov, which couldn’t handle Monday’s rush), Republicans and Democrats made sure their servers could accommodate the extra traffic and process donations.

A Better Way To Handle This

Bragging about record donations caused by the inability to get a deal done just isn’t right.

Nobody likes gloaters, especially if the spoils come at someone else’s expense.

Furthermore, both political parties obviously feel justified and emboldened by the fact that more donors support their fruitless cause. This is bad news. Why?

The announcement to (partially) shut down the government and essentially admit defeat has already been made. This first step was the hardest step. The path of least resistance now is to keep the shutdown going.

Stocks and The Government Shutdown

Stocks didn’t fare well on Thursday. The S&P 500 (SNP: ^GSPC) was down as much as 22 points, the Nasdaq-100 (Nasdaq: ^IXIC) as much as 60 points and the Dow Jones (DJI: ^DJI) well over 150 points.

This drop may not have been a result of the government shutdown though.

In fact, solely based on technical analysis, the September 29 Profit Radar Report expected a drop to at least 1,672. Here’s how the Profit Radar Report put it:

“There’s an open chart gap at 1,672.40. Chart gaps have acted as magnets and the S&P is likely to dip to 1,672 on a ‘chart gap closure excursion.’”

The S&P 500 (NYSEArca: SPY) chart above provides a visual of the open chart gap pointed out by the September 29 Profit Radar Report (red line and oval).

The open gap was closed yesterday. It now is important that crucial support, just below the previously open chart gap, holds.

Chart gaps can provide valuable clues. Here’s another example. The August decline left two open S&P 500 chart gaps at 1,685 and 1,706 (green lines and ovals).

Partially because of those open chart gaps, the August 25 Profit Radar Report stated that: “There are good reasons for stocks to rally. Such as: Open chart gaps at 1,685 and 1,706, VIX (Chicago Options: ^VIX) back below the upper Bollinger Band, and failure to touch a long-term trend channel at the August 2, high.”

Regardless of the government shutdown, stocks are at a potential inflection point (this should lead to a breakout or breakdown) from a technical perspective.

Here is a detailed analysis of the Nasdaq and S&P 500:

Bullish or Bearish? S&P 500 Lagging, Nasdaq at New High Near Double Fibonacci Resistance

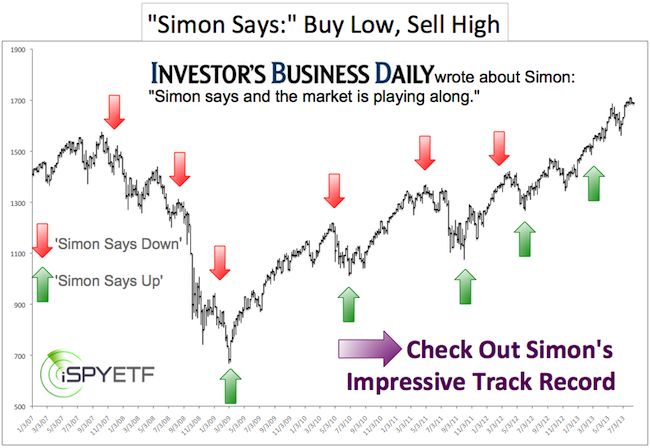

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|