The worst-case scenario is now reality. The government is partially shut down … but Wall Street isn’t too worried about it. In fact, stocks (NYSEArca: VTI) are up.

Are stocks climbing the proverbial ‘Wall of Worry?’

This so-called wall of worry wasn’t ‘built’ by the government shutdown. History shows that government shutdowns do not affect stocks (more below).

A look at sentiment shows that the wall of worry has protected this bull market like a medieval moat protects a castle.

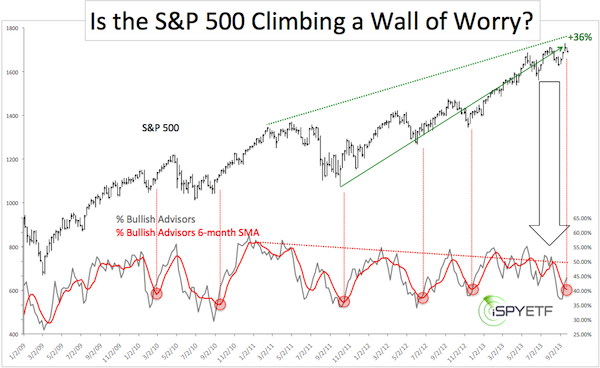

The chart below plots the S&P 500 (SNP: ^GSPC) against the percentage of bullish advisors and newsletter-writing colleagues polled by Investors Intelligence (II).

Included is a 6-week average of the percentage of bulls to add a little more flavor and depth to the sentiment development.

Here are the two key points:

1) The S&P 500 (NYSEArca: SPY) is trading near its all-time high.

2) Investment advisors are relatively bearish considering how well stocks have done.

Here’s what we’d normally expect to see:

Nothing gets investors as excited as rising stock prices. Since stocks have been rising a lot, investors should be excited. But they are not.

Here’s what we’re actually seeing:

As stocks continue to rise, investors are turning bearish. Yes, investors are quite suspicious of the latest rally leg.

Just like a fire, bull markets need fuel. Suspicious or bearish investors are the fuel that keeps the bull market burning higher.

Why? Bearish investors haven’t bought into the rally yet and are the only ones (potential buyers on the sidelines) that can (and usually will) drive prices higher.

Last week, the 6-week average of bullish investment advisors was closer to readings near market bottoms than market tops (red circles).

Here’s what this means:

I previously published an article titled ‘QE Haters are Driving Stocks Higher,’ and that’s exactly what’s happening.

It becomes more obvious if you look at the Nasdaq (Nasdaq: QQQ), Russell 2000 (NYSEArca: IWM) and S&P MidCap 400 (NYSEArca: MDY). Unlike the S&P 500 and Dow, they are all trading at new (all-time) highs.

Based solely on sentiment, stocks have more up side ahead.

What about the government shutdown? How does it affect stocks?

A detailed look at all government shutdowns since 1980 offers a surprising conclusion. In fact, all eleven government shutdowns since 1980 coincided and benefited from a particular seasonal stock market pattern.

A detailed analysis of how exactly this affects the S&P 500 can be found here:

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|