Bears, if you are looking for someone to blame for having been on the wrong side of the trade – look in the mirror.

Yes, the Federal Reserve’s financial alchemists have artificially engineered this QE bull market and yes, the economy is still lagging.

But that’s not the only reason. The stock market is actually using the bears as a springboard for higher prices.

Stock markets don’t roll over until most of the bears throw in the towel, but bears maintain a tight grip on their bearishness even at their own detriment.

This front-page article featured in the May 5, 2012 edition of USA Today sums the situation up nicely:

“Wall Street's long-running story about how stocks are the best way to build wealth seems tired, dated and less believable to many individual investors. Playing the market isn't as sexy as it used to be. Stocks remain out of fashion.”

I remember this time well, because my three key indicators (I call them the three pillars of market forecasting: technical analysis, seasonality and sentiment) were about to line up for a major buy signal.

In a June 3, 2012 update to subscribers I wrote that: “The S&P 500 is within our 1,248 - 1,284 target range for a bottom. Most of my studies suggest higher prices over the coming weeks and a tradable bottom due soon. While June generally falls in the seasonally weak summer period, we find that election year Junes generally sport a strong performance”

The S&P 500 (SNP: ^GSPC) bottomed at 1,266 on June 4, 2012.

Sentiment Sours as Stocks Rally

Since then stocks have rallied and sentiment has soured.

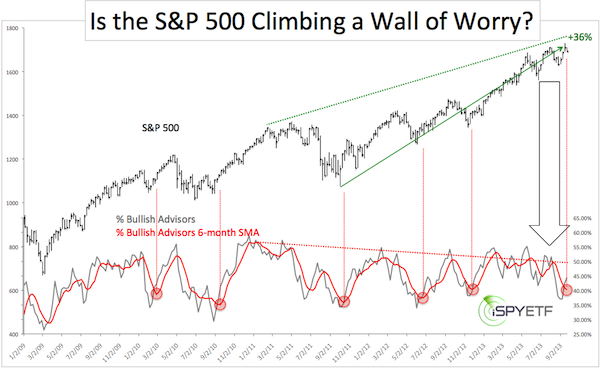

The chart below shows just how stubborn bears are. The S&P 500 ETF (NYSEArca: SPY) soared as much as 36% since its 2012 low, yet the 6-week SMA of bullish investment advisors and newsletter-writing colleagues (polled by Investors Intelligence) is closer to readings seen near bottoms than tops (red circles).

This trend was obvious in early 2013 when the financial media was outright bearish even though the Dow Jones (DJI: ^DJI) just pushed to new all-time highs and the VIX (Chicago Options: ^VIX) was lingering near multi-year lows.

Via the March 10, 2013 Profit Radar Report I shared this observation with my subscribers:

“The Dow surpassed its 2007 high and set a new all-time high last week, but investors seem to embrace this rally only begrudgingly and the media is quick to point out the ‘elephant in the room’ – stocks are only up because of the Fed. Below are a few of last week’s headlines:

CNBC: Dow Breaks Record, But Party Unlikely To Last

Washington Post: Dow Hits Record High As Markets Are Undaunted By Tepid Economic Growth, Political Gridlock

The Atlantic: This Is America, Now: The Dow Hits A Record High With Household Income At A Decade Low

CNNMoney: Dow Record? Who Cares? Economy Still Stinks

Reuters: Dow Surges To New Closing High On Economy, Fed’s Help

The market likes to fool as many as possible and it seems that overall further gains would befuddle the greater number. Sentiment allows for further gains.”

Small Correction, Big Effect

The minor summer correction (big black arrow) has suffocated rising optimism before it had a chance to flourish into extremes.

Now, nearly all major US indexes are near all-time highs – the Nasdaq (Nasdaq: QQQ) is outperforming every other broad market index – but sentiment is at best neutral.

From a sentiment analysis point of view, this suggests yet higher stock prices eventually (this doesn't preclude a deeper correction).

Aside from sentiment, there is an unnoticed but very effective technical pattern that telegraphed the onset of almost every market rally since the 2009 low.

More details about this pattern can be found here:

The Secret QE Bull Market Trade Pattern that Almost Never Fails

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|