Not everything that shines is gold and not every index at new highs is really at new highs.

Germany’s 30-stock blue chip index – the Dax – is trading at all-time highs and is considered the driving force behind Europe’s bounce back.

However, the picture is not as rosy as it looks (in fact it’s much less rosy).

Everyday the Dax is bouncing from one new high to the next, but bellwether stocks like Siemes, SAP and Munich Re are trading well below their all-time high.

Siemens trades 30% below its peak reading, SAP 22% and Munich Re 60%.

How can that be?

The Dax – as quoted by the media – is a total return index, which means that dividends are added to the index. It’s automatically assumed that dividends are reinvested into the index, but dividends don’t increase share prices.

The Dax’s total return approach is unique among its peers. The Dow Jones (DJI: ^DJI) is price weighted, the S&P 500 (SNP: ^GSPC) is market cap weighted, as is the Nasdaq (Nasdaq: QQQ). None of them ‘reinvest’ dividends into the index. Most international indexes and ETFs like the iShares MSCI EAFE (NYSEArca: EFA) do not use the Dax's total return methodology.

What’s the difference?

The chart above illustrates the difference between the Dax Performance Index (including dividends) and the Dax Kurs Index (excluding dividends).

The Dax Performance Index trades 47% higher than the ex-dividend index.

You may think what happens across the pond doesn’t affect you, but US investors own a huge chunk of the Dax. In fact, one single US investment company owns 6% of the Dax and all US investors own much more.

Exactly how much money US investors have parked in ‘made in Germany’ is discussed here: US Investors Own xx% of Germany

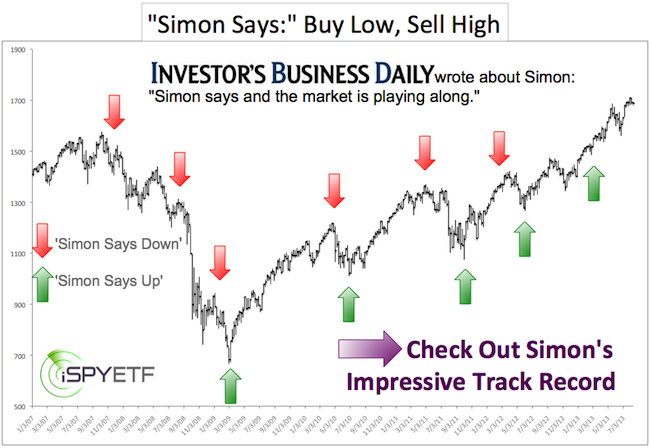

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|