This came in from Germany’s Handelsblatt newspaper:

European Central Bank (ECB) President Mario Draghi is concerned about the European banking system and is ready to unleash more emergency loans.

His concern however is over the ‘wrong reason.’ What’s the wrong reason?

Excess liquidity in the European financial system has dropped from 800 billion euro to euro 225 billion.

This sounds like bad news, but it’s not.

Liquidity has dried up because European banks are paying back their 3-year LTRO loans sooner than necessary.

Here’s a brief refresher on LTRO, which stands for Long-term refinancing operations. LTRO is essentially the European counter part to QE.

There were two tranches, LTRO I and LTRO II.

-

Via LTRO I (December 21, 2011) the ECB provided euro 489 billion worth of 1%, 3-year loans to 523 banks.

-

Via LTRO II (February 29, 2012) the ECB provided euro 529.5 billion worth of 1%, 3-year loans to 800 banks.

Good News, Bad News - All Good News

This is a good news/bad news kind of scenario.

The good news is that banks are doing well enough to repay their loans sooner.

The bad news is that shrinking liquidity has resulted in higher interest rates for bank-to-bank lending.

This development threatens to choke the economic recovery in the euro zone.

“We will watch this development very carefully,” says Draghi.

No doubt they will. How dare a natural side effect of an artificial medicine challenge the EU spin doctor.

What it Means for Investors

In theory more euro loans would be bad for the euro (NYSEArca: FXE) and good for the dollar (NYSEArca: UUP). In reality, technical analysis is likely a better indicator if you are trying to figure out what’s next for the euro and dollar.

How will it affect European stocks? If European stocks (NYSEArca: VGK) respond to liquidity like US stocks (NYSEArca: SPY), we can assume that good news is good for European stocks (NYSEArca: FEZ) and that bad news is good for stocks, as long as the ECB keeps the money going.

To assure just that, Draghi confirmed that banks will have access to cheap money for years to come.

Below is a small selection of news featured in German newspapers (translated into English). You’ll find that German news sometimes brings out facets omitted domestically or simply offer a different take.

Popular German Newspaper Exclaims: Stocks Are on Drugs!

Handelsblatt: Hank Paulson Warns of Another Financial Crisis

German Newspaper Asks: “Will the Financial System Collapse?”

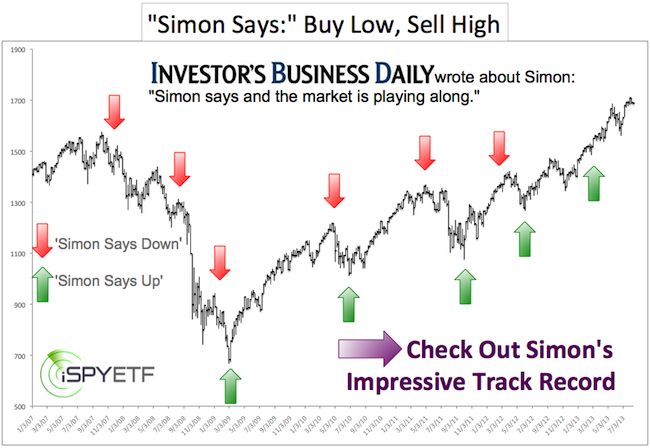

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|