QE for the stock market is like drugs for a junkie. QE has the same effect (high) and the same eventual outcome (crash).

However, I had never seen this analogy on the front page of a major newspaper … until this week.

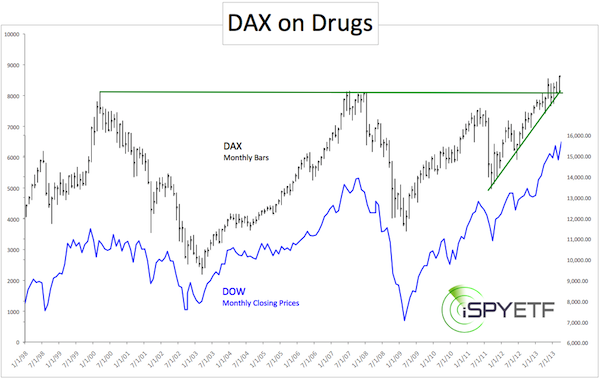

The Handelsblatt, Germany’s finance and economy newspaper, featured the “DAX on Drugs” (DAX auf Droge) article on the front page of the September 17 edition (image below).

The Handelsblatt writes (translated from German into English): “The flood of new money from central banks is driving stocks higher. For years, low interest rates have been a fast acting drug. Stocks are on a high. But more and more experts are warning of the dramatic consequences of inevitable withdrawal. Investors know that central banks are manipulating stock prices.”

That’s pretty blunt, but it doesn’t stop there: “In deed, it’s tough to find fundamental reasons for rising prices. Corporate profits are not keeping up with share prices. Even though analysts for 22 of the 30 DAX components lowered their profit forecasts, prices only moved in one direction, up.”

Stocks are Up, What’s the Problem?

Handelsblatt describes it this way: “The problem: Central banks are a temporary savior, but don’t eliminate the cause of the crisis, which is the enormous debt of citizens, corporations and countries. This creates an ever-growing addition to cheap money. Without this doping markets will crash. The longer markets are pushed up, the stronger the correction will be.”

Here’s what’s interesting about this article:

1) It graces the front page of a reputable newspaper

2) It talks about crisis even though the German DAX and US indexes are at all time highs

3) It openly and unmistakably shows the link between cheap money and share prices, calling it manipulation

4) It specifically refers to the Federal Reserve

What to Make of This

From a technical or chart analytical perspective, the German DAX is trading above strong support around 8,100. The up trend is in tact as long as trade stays above.

As a side note, there is no US traded ETF that replicates the DAX index (similar to the Dow Jones, the DAX consists of 30 ‘blue chip’ companies). The iShares MSCI Germany Index (NYSEArca: EWG) offers the best representation of the German stock market.

Germany obviously is Europe’s growth engine. The German stock market also accounts for 8.57% of the iShares MSCI EAFE International ETF (NYSEArca: EFA) and sports a close correlation to ‘our’ index of 30 blue chips, the Dow Jones (DJI: ^DJI).

The correlation to our Dow (NYSEArca: DIA) and S&P 500 (NYSEArca: SPY) makes the sentiment implication of the Handelsblatt article interesting.

Sentiment is a contrarian indicator, and the obviously bearish observations shared on the front page of a major newspaper are bullish for stocks. If it’s bullish for German stocks, it should also be bullish for US stocks.

If stocks rally despite obvious concerns, one wonders if anything can stop this QE bull? The following article takes a close look at this question and outlines what it will take to ‘slaughter’ this bull:

Who or What Can Kill This QE Bull Market?

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|