Good-bye Hewlett-Packard, Bank of America, and Alcoa. Hello Nike, Goldman Sachs, and Visa.

The Dow Jones Industrial Average (DJI: ^DJI) is undergoing its most dramatic facelift in a decade and will morph into a much more financial sector focused average. The changes will go into effect September 20, 2013.

I see the following risks short and long-term:

Short-term Reshuffling Risks

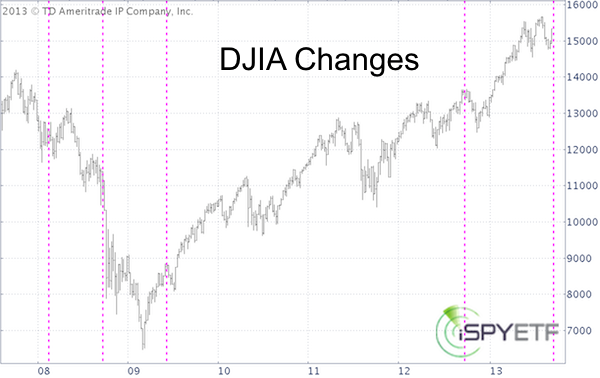

In recent years reshuffling components was followed by temporary corrections. The weekly DJIA chart below chronicles changes and the effect on the Dow since February 2008 (there was no change from November 2005 – February 2008).

The short-term performance immediately following the shuffle was generally negative, although the losses were limited. Long-term was in line with random.

Long-term Reshuffling Risks

S&P Dow Jones Indexes, a subsidy of McGraw-Hill (which is also the parent company of Standard & Poor’s and J.D. Power and Associates), dropped one financial name (BofA) from the mighty Dow and added two (Goldman Sachs and Visa).

But the exposure to financials is more significant than even the two for one swith suggests. Why?

The Dow Jones (NYSEArca: DIA) is a price-weighted gauge, that’s why it’s called an average not an index. Price-weighted simply means that the stock with the biggest price tag carries the most weight. Currently that’s IBM. At $190 a share IBM accounts for 9.43% of the DJIA and is the unquestioned VIP (Chevron, the 'runner up,' trades at $123).

Soon to be deleted Bank of America trades at $14.50 and accounts for 0.74% of the index (keep in mind that the index has only 30 components). That means that BAC would have to move 13 times as much as IBM to match IBM’s effect on the average.

Currently financials are the fifth biggest sector of the DJIA and account for only 11.39%. Here’s where it gets interesting:

Visa trades at $186 and Goldman Sachs at $165. The top three holdings of the Dow Jones will be IBM, Visa and Goldman Sachs. Based on a quick thumbnail assessment, financials will soon be the biggest sub-sector of the Dow with an allocation around 25%.

We shouldn’t forget that the Financial Select Sector SPDR ETF (NYSEArca: XLF) and SPDR S&P Bank ETF (NYSEArca: KBE) lost 85% from 2007 to 2009, significantly underperforming the S&P 500 (NYSEArca: SPY), which was down ‘only’ 57%.

So the heavy financial weighting of the Dow can be a negative.

In fact, former Treasury Secretary Hank Paulson mentioned in a guest contribution for a German finance and economy newspaper that he fears yet another financial ‘firestorm’ (firestorm is the term he used).

According to Paulson the financial sector is quite vulnerable. This article explains in detail the problem Paulson warns of: Hank Paulson Warns of Another Financial Crisis.

Also of interest: Why the Dow is The Most Flawed 'Index' in The World

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter or sign up for the FREE Newsletter.

|