Not everything that shines is gold and even the real stuff is worth much less today than yesterday, or any other day since September 2010.

Gold, the last honest asset and conscience of the financial world, reminds complacent investors of a time-tested but forgotten principle: What goes up must come down.

Gold’s fate has been a frequent topic of discussion in the Profit Radar Report. Ever since the April 16 low of $1,321/oz, the Profit Radar Report has been expecting a new low in the 1,250 – 1,300 range.

One reason to look for new lows came from a basic but reliable indicator – RSI (Relative Strength Index). There was no bullish RSI divergence at the April 16 low.

Weeks of sideways trading allowed RSI to reset and hold up much better than prices. A bullish RSI divergence is now in place (see chart).

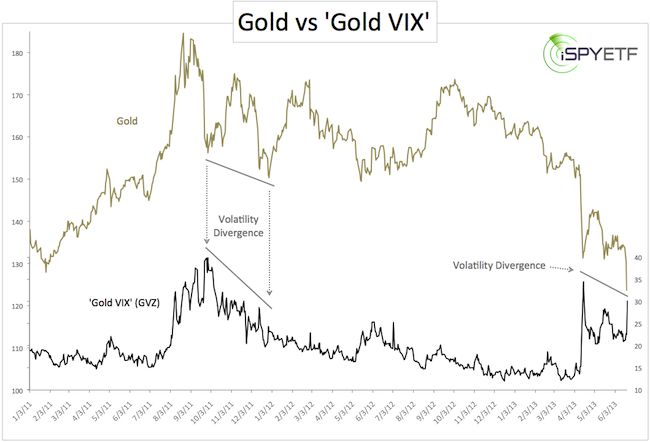

The CBOE Gold ETF Volatility Index (GVZ) also suggested a new low. GVZ basically is a VIX or ‘fear barometer’ for the Gold ETF (GLD).

The chart below plots the SPDR Gold Shares (GLD) against the CBOE Gold ETF Volatility Index (GVZ) and provides an update to the chart featured in the April 16 Profit Radar Report.

The December 2011 bottom was accompanied by, what I call, a volatility divergence. Volatility at the initial September 2011 low was much higher than at the December 2011 low.

Volatility divergences are not unique to the gold market. In fact, similar volatility divergences helped me identify major stock market lows in March 2009, October 2011 and June 2012.

Yesterday’s new low for GLD and gold prices was accompanied by such a volatility divergence.

Setup For a Buy Signal

Based on technical indicators, the conditions are in place for a low. Investor sentiment is extremely bearish, which is conducive for higher gold prices.

However, we need to remember that gold has been in a 10-year bull market and therefore should not overvalue the current sentiment extremes. The fact that gold prices haven’t been able to get off the mat in weeks, despite bearish sentiment extremes, suggests that gold has entered a new environment – it used to be called a bear market.

Regardless, we expect some sort of a gold bottom in the 1,250 – 1,300 range with the potential for a powerful bounce. The conditions are right to start fishing a bottom, but there’s no reason to be careless. Lower price targets are still possible.

The focus of the Profit Radar Report will be on finding low-risk buy levels that gives us all the benefits of a nice rally without any of the pain of being wrong or too early.

|